The Impact of St George on Australia’s Banking Sector

Introduction

St George Bank, a prominent participant in the Australian banking landscape, has continually adapted to meet the evolving needs of its customers. Founded in 1937 in Sydney, the bank has grown from its modest roots to become a significant player under the Westpac Banking Corporation umbrella. Understanding the bank’s journey is essential for recognising its role in Australia’s financial services sector, particularly in an era marked by digital transformation and competitive pressures.

Recent Developments

In recent months, St George has enhanced its services aimed at improving customer experience and financial inclusivity. The launch of new digital banking features has positioned the bank as a frontrunner in leveraging technology to serve its clientele. According to the bank’s quarterly reports, St George has seen a significant uptick in customer engagement through their mobile and online banking platforms, which has become increasingly critical amid the Covid-19 pandemic’s lasting effects on consumer behaviour.

Moreover, St George is putting a strong emphasis on sustainability and ethical banking practices. The bank’s commitment to reducing its carbon footprint and investing in renewable energy projects aligns with the broader trend within the industry towards corporate responsibility. Recently, they announced plans to allocate AUD 2 billion in loans to projects focused on environmental sustainability over the next five years.

Challenges Faced

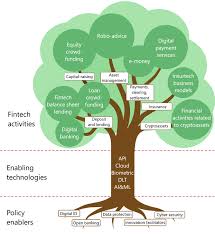

Despite these advancements, St George continues to navigate challenges typical of the banking sector. Increased competition from fintech firms and digital-only banks has intensified pressure to innovate and maintain customer loyalty. Recent reports indicate that traditional banks, including St George, are facing increased customer expectations regarding service speed and accessibility.

Additionally, ongoing regulatory scrutiny and changing economic landscapes due to inflation concerns pose challenges that require adaptive strategies. The bank has maintained a proactive approach, reassessing its portfolios and risk management practices to withstand unforeseen disruptions.

Conclusion

The future of St George Bank appears promising as it continues to evolve in response to market dynamics. By focusing on technological innovation and sustainability initiatives, St George is poised to strengthen its position within the Australian banking sector. With an increasing number of customers seeking online banking solutions and ethical options, the bank’s commitment to these areas could serve as a blueprint for its continued success. Observers predict that, if these trends continue, St George may indeed emerge as a leading force in the financial services landscape, shaping how Australians view modern banking.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.