The Impact of Recent Iran Attack on Global Stock Market

Introduction

The recent attack in Iran has raised significant concerns regarding its impact on the global stock market. Investors closely monitor geopolitical events, as they can trigger volatility, affecting stock prices and market stability. Understanding the ramifications of such incidents is crucial for both investors and analysts as they navigate the turbulent waters of the financial markets.

Details of the Attack

On October 15, 2023, Iran faced a targeted strike by an unknown military force, leading to fatalities and a heightened state of alert within the region. The attack was part of ongoing tensions involving both regional and international powers. In response, Iranian officials have vowed to retaliate, intensifying fears of an escalation in hostilities.

Initial Reactions from the Stock Market

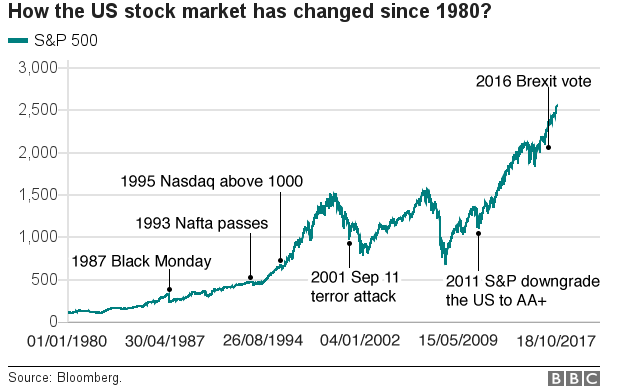

Following the attack, the global stock markets reacted swiftly. Key indices such as the S&P 500 and FTSE 100 saw significant drops in value. Investors fled towards safe-haven assets like gold and U.S. treasury bonds, which saw prices surge as confidence in stock market stability waned. Notably, the energy sector experienced a spike, with oil prices climbing due to concerns over potential disruptions in Iranian oil exports.

The Broader Economic Implications

Analysts believe that the ongoing geopolitical instability could lead to higher oil prices, which would ultimately have ripple effects across various sectors. Higher energy costs could fuel inflation, affecting consumer spending and potentially leading to a slowdown in economic growth. Moreover, if retaliatory actions escalate, it could lead to more sanctions and impact global trade, further fuelling investor anxiety.

Market Recovery and Future Outlook

While the initial reaction was negative, market analysts suggest that the stock market may recover relatively quickly if tensions de-escalate. Historically, the markets have shown resilience and a capacity to bounce back from geopolitical shocks. However, investor sentiment will remain fragile, and volatility is expected as the situation in Iran evolves.

Conclusion

The recent attack in Iran has undeniably impacted the global stock market, illustrating the intricate relationship between geopolitical events and financial markets. Investors must remain vigilant and informed, as the implications of this conflict could extend far beyond immediate stock price fluctuations. As tensions in the Middle East continue, the market’s reaction will serve as a crucial barometer for global economic conditions moving forward.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.