The Impact of Iran Attacks on the Stock Market

Introduction

The recent escalation of tensions in Iran has led to a significant impact on global financial markets. Events such as military conflicts and attacks can create uncertainty, leading to fluctuations in stock prices. Understanding how these developments affect the stock market is crucial for investors and stakeholders seeking to navigate an unpredictable environment.

The Iran Attacks and Their Implications

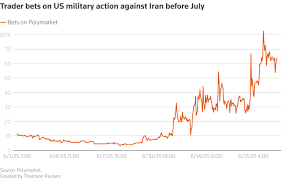

In recent weeks, reports of drone strikes and military engagements in Iran by foreign adversaries have captured global attention. As of late October 2023, the Iranian military has been involved in retaliatory acts, and the geopolitical climate in the region has intensified considerably. These developments have raised fears of broader conflict, causing investors to reassess their portfolios.

The stock market has reacted sharply; U.S. stock indices, including the S&P 500 and Dow Jones Industrial Average, saw a significant downturn in response to breaking news about the latest attacks. Investors often respond to geopolitical events with a flight to safety, pulling out of equities in favour of traditionally safer assets such as gold and U.S. treasuries. Following the attacks, gold prices surged, reaching their highest levels in several months, which indicates heightened uncertainty among investors.

Market Reactions and Economic Forecasts

Major stock exchanges around the world, including those in Europe and Asia, mirrored the declines seen in the U.S. markets. Markets in countries with close ties to Iran, such as those in the Middle East, experienced more volatility, with some indices dropping by over 5% in a matter of days. Analysts predict that if tensions continue to escalate, there may be further market declines, driven by increased oil prices and supply chain concerns.

Experts emphasize that while the immediate impact on stock prices may be negative, historical trends suggest that markets often rebound once tensions ease. Investors are now urged to maintain a long-term perspective while considering the potential for continued volatility in the short term. Financial advisors recommend that investors diversify their portfolios to mitigate risks associated with geopolitical uncertainties.

Conclusion

The current situation in Iran underscores the intricate link between geopolitical events and market behaviour. As the world watches the developments unfold, it is evident that attacks and conflicts can have far-reaching effects on global stock markets and investor confidence. The importance of staying informed and considering long-term investment strategies cannot be overstated. For those looking to navigate these turbulent waters, vigilance and adaptability will be key.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.