The Current State of Alcohol Tax in Australia

Introduction

Alcohol taxation is a significant topic in Australia, influencing public health policies, economic strategies, and consumer behaviour. The discussion around alcohol tax is particularly relevant as Australians grapple with rising alcohol consumption rates and the associated health implications. Recent changes in government policy and ongoing debates over tax reforms spotlight the importance of how alcohol is taxed in the Australia’s socio-economic landscape.

Current Alcohol Tax System

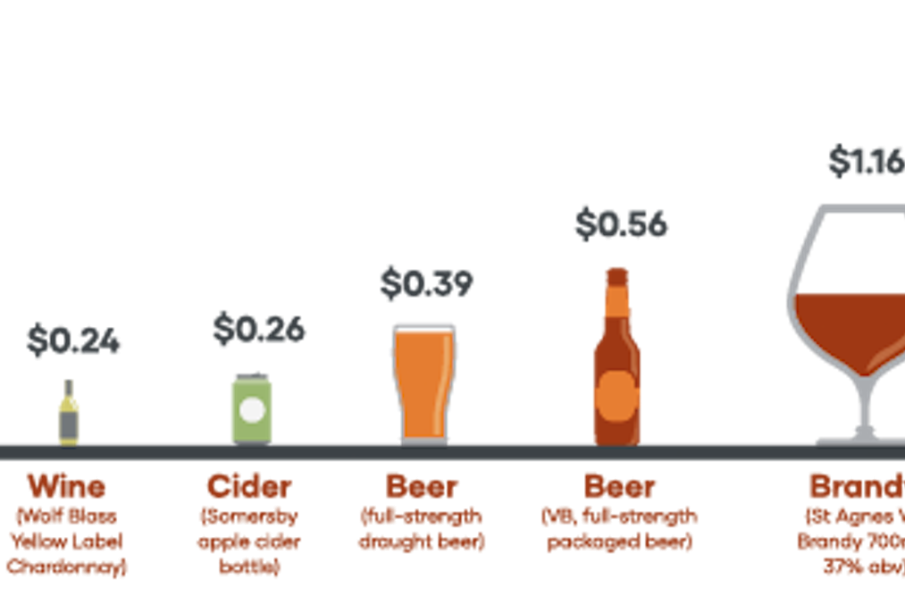

The Australian government implements a specific tax regime that includes the Wine Equalisation Tax (WET), the Beer Excise Duty, and the Spirits Equalisation Tax. Each of these taxes plays a pivotal role in regulating the pricing of alcoholic beverages. For example, beer is taxed per litre of alcohol content, while wine is taxed based on the value of the product. According to the Australian Bureau of Statistics, alcohol sales have increased by 3.6% over the past year, prompting discussions on the efficacy of the current tax model.

Recent Developments

In 2023, the Australian government initiated an inquiry into the alcohol taxation system aimed at addressing the loopholes and inequities perceived within the current framework. Advocates for reform argue that the existing system disproportionately impacts low-income consumers while failing to significantly curtail excessive drinking behaviours. They highlight that measures such as increasing excise rates on spirits and beer could generate additional revenue that can be reinvested in health programs and education.

However, the alcohol industry is pushing back against proposed tax hikes, arguing that increased costs could hurt businesses and lead to job losses in the sector. Recent reports suggest that small breweries and distilleries are particularly vulnerable to changes in tax policies, as their profit margins are often thin.

Conclusion

The debate surrounding alcohol tax in Australia continues to evolve. In the coming months, the government’s inquiry findings may lead to significant reforms that could alter the pricing structure of alcoholic beverages significantly. With public health experts advocating for higher taxes to reduce consumption levels, the government faces the challenging task of balancing economic interests with public health priorities. Readers should stay informed about these developments as the implications of alcohol taxation will affect both individual consumers and the broader Australian economy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.