The Current State and Impact of Inflation in Australia

Introduction

Inflation has emerged as a critical concern for economies worldwide, and Australia is no exception. With rising prices affecting everyday necessities such as food, fuel, and housing, understanding inflation is essential for consumers, policymakers, and businesses. This article delves into the current trends in inflation, the contributing factors, and their significance on the Australian economy.

Current Inflation Trends

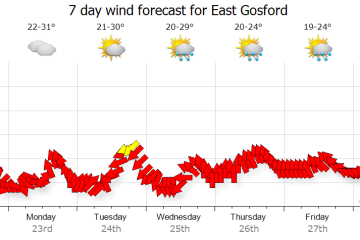

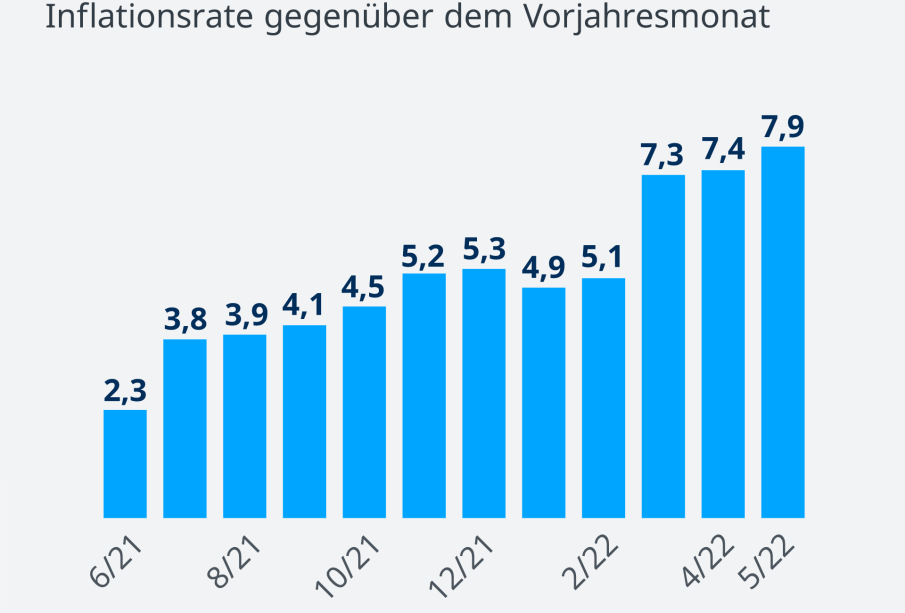

As of October 2023, Australia’s inflation rate stands at approximately 5.6%, reflecting a moderate decrease from earlier this year when it peaked at 7.8%. This decline is a result of various factors, including supply chain improvements and tighter monetary policies adopted by the Reserve Bank of Australia (RBA). Despite this decrease, inflation remains above the RBA’s target range of 2-3%, signaling that cost pressures are still prevalent.

Contributing Factors

Several factors contribute to the current state of inflation in Australia. One major influence is the global economic environment, particularly the ongoing impacts of the COVID-19 pandemic. Disrupted supply chains and labour shortages have led to increased costs for manufacturers and service providers, which are often passed on to consumers.

Additionally, the rise in energy prices, driven by geopolitical tensions and changes in demand patterns, has exacerbated inflationary pressures. According to the Australian Bureau of Statistics, energy costs have surged by over 30% in the past year, significantly affecting household budgets.

The Impact on Households and Businesses

Inflation has direct and indirect effects on households and businesses across Australia. For everyday Australians, the rising cost of living means tighter budgets and potential changes in spending habits. Consumers are becoming more conscious of their purchases, opting for cheaper alternatives or delaying non-essential expenses.

Businesses are also feeling the strain, with many facing increased operational costs. To maintain profit margins, some companies may resort to raising prices, potentially leading to further inflationary cycles. According to a recent survey by the Australian Industry Group, nearly 60% of businesses reported plans to increase prices in response to elevated costs.

Conclusion

The implications of inflation in Australia are significant and far-reaching. As the RBA continues to navigate monetary policy to combat inflation, forecasts suggest that the inflation rate will gradually decline to around 4% by mid-2024, provided that external factors stabilize.

For consumers, staying informed about inflation trends and adjusting budgeting strategies is vital. While inflation may appear to be easing, its impacts on purchasing power will require careful consideration in the coming months.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.