The Current Landscape of Interest Rates in Australia

Introduction

Interest rates are a critical economic indicator that affects consumers and businesses alike. In Australia, the Reserve Bank of Australia (RBA) plays a pivotal role in setting these rates to manage inflation and support economic growth. Recently, rising interest rates have garnered significant attention as they influence everything from mortgage repayments to business investments, making it imperative for Australians to stay informed about the current trends and forecasts.

The Recent Developments

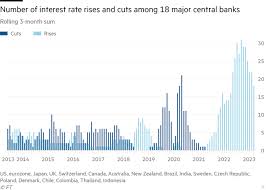

As of October 2023, Australia’s central bank, the Reserve Bank of Australia, has raised interest rates six times this year, resulting in the cash rate increasing from a record low of 0.1% to 4.1%. The decision has been influenced by persistent inflationary pressures in the economy, which have seen inflation rates around 6%—well above the RBA’s target of 2-3%.

These rate hikes are part of the RBA’s strategy to temper inflation, which has been exacerbated by factors such as supply chain disruptions and rising energy costs amid global economic uncertainties.

Impact on Consumers and Businesses

The increases in interest rates have substantial consequences for Australian consumers. Homeowners with variable rate mortgages are already feeling the pinch with their repayments significantly increasing, while potential homebuyers may be deterred by higher loan costs. This has led to a slowdown in the housing market, with recent data indicating a decline in property sales and prices.

Additionally, businesses are facing increased borrowing costs, which may affect their capacity to invest, hire, and expand. Higher interest rates can also lead to reduced consumer spending as individuals prioritise paying off debt rather than making new purchases. This shift could have broader implications for the Australian economy, potentially leading to slower economic growth.

Future Outlook

Economists are divided on the future direction of interest rates. Some predict further hikes could occur if inflation remains unmanageable, while others suggest that the RBA might take a more cautious approach if economic growth begins to falter. The consensus is that maintaining a balance will be crucial—ensuring inflation is controlled while supporting economic stability.

Conclusion

In conclusion, the shifts in interest rates underscore the interconnectedness of monetary policy and everyday life in Australia. As the RBA navigates challenges, it is essential for consumers and businesses to remain adept and informed about these changes. The impact of these decisions will be felt across various sectors, influencing economic activities for years to come. Staying abreast of interest rate developments will be vital as Australians prepare for potential financial adjustments in the near future.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.