Tesla Share Price: Current Trends and Market Analysis

Introduction

The Tesla share price remains a focal point of interest in the financial markets, influencing investor decisions and broader economic discussions. As one of the leading electric vehicle manufacturers globally, Tesla’s stock performance reflects not only the company’s success but also consumer sentiment towards sustainable technology and innovation. Recent fluctuations in the share price have raised questions about the company’s future trajectory and its implications for the automotive industry.

Current Trends in Tesla’s Share Price

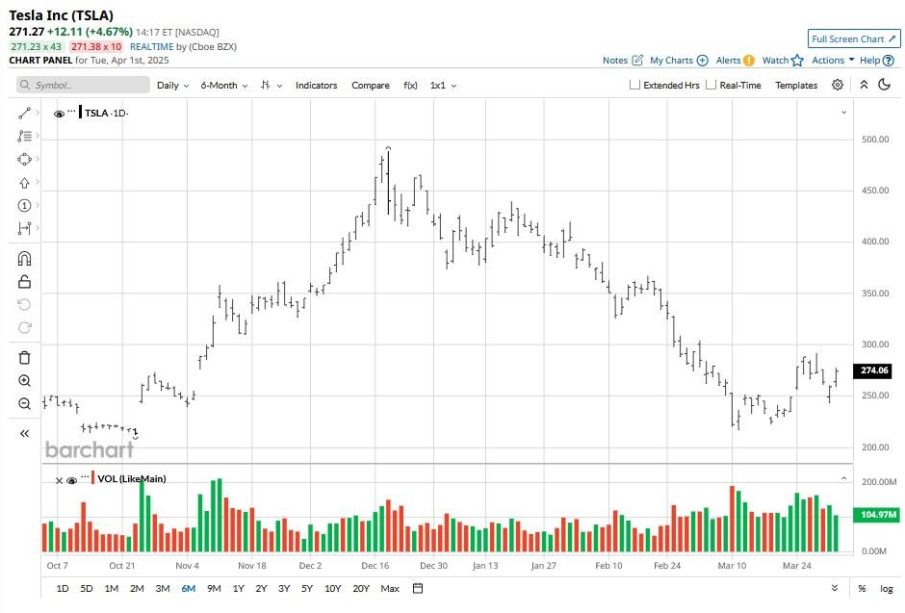

As of October 2023, Tesla’s share price has seen significant volatility, experiencing peaks and troughs driven by various internal and external factors. After a strong rally earlier in the year, the stock rose by over 25%, fueled by quarterly reports indicating robust sales growth, improved production efficiency, and expanding market reach. However, in recent weeks, the share price has dipped by around 15% amid concerns over rising competition in the EV market, supply chain challenges, and macroeconomic factors such as inflation.

Moreover, the impact of interest rates on tech stocks has been significant, as higher rates typically lead to decreased valuations for growth companies like Tesla. Analysts are closely watching how these economic indicators will affect Tesla’s future performance and profitability.

Factors Influencing Tesla’s Share Price

Several factors influence Tesla’s share price beyond market trends. The company’s production capacity, particularly with the opening of new Gigafactories in Berlin and Texas, plays a crucial role in meeting rising demand. Additionally, Tesla’s innovation in battery technology and software development continues to position it competitively against traditional automakers entering the electric market.

Furthermore, broader market conditions, such as geopolitical tensions and regulatory changes in key markets, also impact investor confidence. Tesla’s commitment to reducing production costs while increasing vehicle affordability remains a pivotal element in its strategy to maintain market leadership.

Conclusion

In conclusion, the Tesla share price is poised to reflect ongoing developments in the electric vehicle sector and broader market dynamics. Investors are encouraged to keep an eye on company announcements regarding production innovations, market expansions, and responses to competitive pressures. As the electric vehicle market continues to evolve, Tesla’s share price will likely remain a critical indicator of the company’s health and the industry’s direction. Future growth could depend heavily on how well Tesla navigates challenges and leverages opportunities in the years to come.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.