Stock Markets Respond to Tariffs: Current Trends and Insights

Introduction

The relationship between stock markets and tariffs is a crucial topic in current global economic discussions. With the ongoing tension related to international trade, particularly between the United States and China, understanding how stock markets respond to tariff announcements and trade policies is vital for investors, businesses, and policymakers. Recent fluctuations in stock prices indicate that market participants are highly attuned to tariff-related news.

Market Reactions to Recent Tariffs

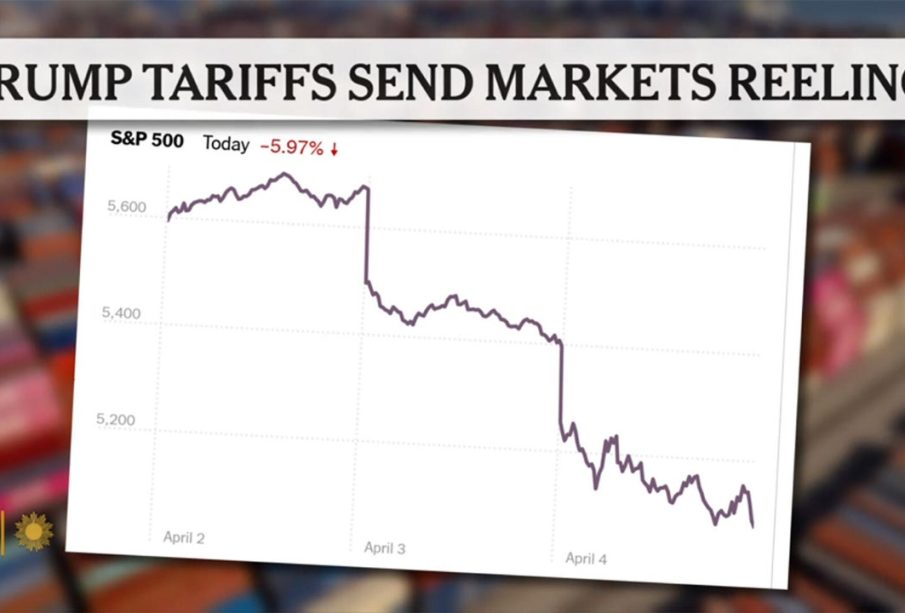

In the past month, the US stock markets have experienced significant volatility. For instance, after the Biden administration announced new tariffs on certain Chinese goods, major indices such as the S&P 500 and Nasdaq reacted with declines. Analysts suggest that these market movements are influenced by investor fears regarding rising costs for consumers and potential disruptions to supply chains.

On the contrary, when there are signals of potential negotiations or reductions in tariffs, such as the optimistic remarks from both the US and Chinese governments recently, stock markets tend to rally. The Dow Jones Industrial Average rose by 300 points following reports of productive discussions between the two nations.

The Bigger Picture: Stock Market vs. Economic Policies

Moreover, the stock market’s reaction to tariffs underscores a broader trend: market sentiment is increasingly prioritising the prospect of economic growth over concerns regarding trade barriers. For example, a surge in technology stocks might often outpace declines caused by tariff announcements, suggesting that investors are focusing on long-term growth prospects instead of short-term tariff impacts.

As companies adjust strategies to accommodate tariffs—whether by increasing local production or finding alternative suppliers—the resilience of the stock market in the face of these changes is revealing. The report from the Australian Bureau of Statistics showed a 2% increase in manufacturing output, indicating that companies may be better equipped to navigate tariff challenges.

Conclusion

The ongoing interplay between stock markets and tariffs presents both challenges and opportunities for investors. As markets continue to respond to political shifts and trade negotiations, keeping a close eye on tariff announcements and geopolitical developments will be essential. Analysts recommend that investors diversify their portfolios to hedge against potential risks posed by tariffs, while also looking to sectors that are less affected by these policies.

In conclusion, the phrase ‘stock markets trump tariffs’ resonates strongly in the current economic landscape, signalling that while tariffs will influence market behavior, ultimately, investor sentiment and economic fundamentals will drive long-term trends. As we move forward, it remains to be seen how evolving economic policies will continue to shape the markets.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.