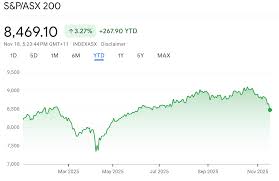

Significant Declines in the Australian Stock Market Today

Introduction

Today, the Australian stock market faced a substantial downturn, raising alarms among investors and analysts alike. As economic indicators continue to shift and global markets react, understanding the causes and implications of this crash becomes crucial for both investors and everyday Australians.

Details of the Market Crash

The Australian Securities Exchange (ASX) saw a decline of over 3% in major indices, including the ASX 200, as trading commenced this morning. The drop was attributed to heightened fears surrounding inflation and rising interest rates. Moreover, international markets have been volatile, reflecting similar concerns and contributing to a lack of confidence among Australian investors.

The decline was particularly pronounced in sectors such as technology and finance, which saw a significant sell-off. Leading companies, including Afterpay and Commonwealth Bank, reported steep losses, forcing many retail investors to reconsider their portfolios. Analyst predictions suggested that volatility might continue as the Reserve Bank of Australia prepares for potential interest rate hikes in response to inflation trends.

Global Context

Comparing the situation on the ASX with international trends shows a concerning picture. Global markets are reeling from ongoing geopolitical tensions and economic uncertainties, particularly with the looming threat of recession in major economies. For instance, the US stock market also experienced declines, with the S&P 500 and NASDAQ composite falling sharply, influencing investor behaviour in Australia.

Conclusion

The Australian stock market’s crash today serves as a wake-up call for investors to reassess risk management strategies amid changing economic conditions. While some analysts predict potential rebounds, the overall sentiment remains cautious. Investors are advised to stay informed and consider long-term strategies rather than succumbing to panic selling during such turbulent times.

As the situation develops, close attention to both local and global economic indicators will be essential. The coming days may offer insights into whether today’s crash is a temporary setback or a signal of more serious issues within the broader market landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.