RBA Interest Rates: Central Bank Signals Further Cuts Ahead as Economy Cools

Latest RBA Rate Decision and Economic Impact

The Reserve Bank of Australia has recently lowered the cash rate by 25 basis points to 3.60 per cent, noting that inflation has fallen substantially since its peak in 2022 as higher interest rates have helped bring aggregate demand and potential supply closer to balance.

The central bank has also reduced its economic growth forecast for the year to 1.7% from 2.1%, citing weaker-than-expected public demand in early 2025 that is unlikely to be offset through the remainder of the year.

Current Economic Conditions

Recent data shows trimmed mean inflation over the year fell to 2.7 per cent, while headline inflation, affected by temporary cost of living relief measures, was 2.1 per cent.

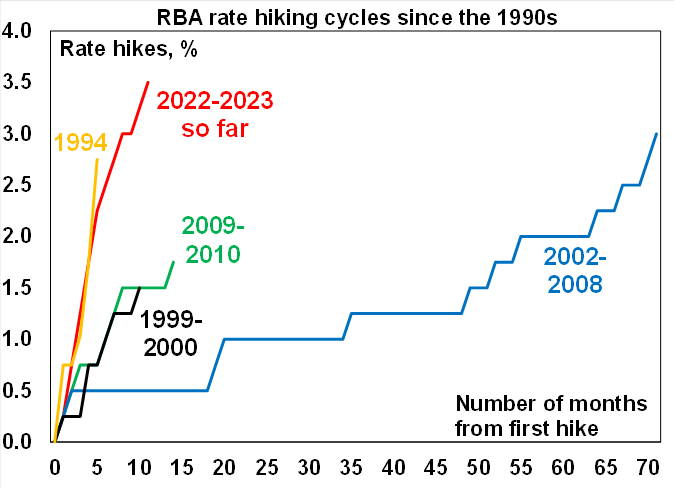

This latest cut follows a significant shift in monetary policy, with the RBA beginning to lower rates at the start of 2025 after several years of steep hikes and a year without movement in 2024. The bank has implemented three cuts so far this year.

Future Outlook and Market Expectations

Major banks are predicting further rate cuts ahead:

– ANZ and CBA forecast a 25 basis point cut in November, taking the cash rate to 3.35%

– NAB and Westpac expect a 25 basis point cut in November and another in February, potentially bringing the rate down to 3.10% by early 2026.

However, uncertainties remain about the outlook for domestic economic activity and inflation. While forecasts suggest household consumption growth will be sustained as real incomes rise, some businesses report ongoing challenges in passing on cost increases due to weak demand.

Global Context and Risks

The RBA has indicated that while the risk of a “very damaging” trade war has diminished, with recent international trade policy developments having minimal impact on the Australian economy, they warn that more significant disruption to global trade cannot be ruled out. The lower GDP growth forecast is primarily attributed to a reduced outlook for productivity growth rather than trade disruptions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.