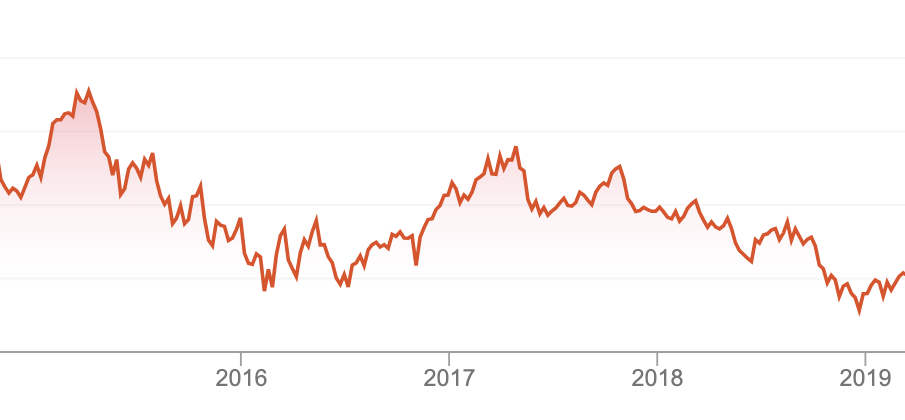

NAB share price: What investors need to know

Introduction — Why the nab share price matters

The nab share price is closely watched by retail and institutional investors across Australia because movements in the bank’s stock reflect broader confidence in the financial sector and the domestic economy. As one of the major banks, changes in NAB’s market value can influence portfolio allocations, dividend expectations and perceptions of credit risk. Understanding what drives the nab share price helps readers make more informed investment and financial-planning decisions.

Main developments and drivers

Economic and policy influences

Interest-rate settings, inflation trends and broader economic growth are primary influences on the nab share price. When borrowing rates change or inflation expectations shift, bank margins and lending volumes can be affected, which in turn drives investor sentiment. Monetary policy decisions and guidance from central banks are therefore monitored closely by market participants.

Company performance and dividends

Regular profit results, loan growth, asset quality and dividend announcements are direct company-level factors that move the nab share price. Strong earnings and a sustainable dividend policy typically support higher share valuations, while disappointing results, rising bad debt provisions or unexpected charges can prompt declines. Investors often focus on net interest margin, cost control and credit impairment metrics when assessing bank stocks.

Market and sector conditions

Broader equity-market trends and sentiment toward the financial sector influence the nab share price. Global market volatility, shifts in investor risk appetite, and regulatory developments affecting banks can all produce short-term price swings. Comparisons with peers also play a role, as investors assess relative valuation and growth prospects across major banks.

Conclusion — What this means for readers

For investors and observers, tracking the nab share price is a way to gauge both company health and wider economic signals. Short-term movements are often driven by news, earnings and market sentiment, while long-term returns depend on consistent profitability, prudent risk management and dividend sustainability. Readers considering exposure to NAB should combine share-price analysis with an assessment of their risk tolerance and investment horizon, and seek professional financial advice if unsure. Monitoring macroeconomic indicators and company updates will remain essential for anticipating future shifts in the nab share price.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.