Latest Updates on RBA Interest Rates

Importance of RBA Interest Rates

The Reserve Bank of Australia (RBA) plays a pivotal role in shaping the economic landscape of Australia through its monetary policy decisions, particularly regarding interest rates. Changes in RBA interest rates can have profound effects on borrowing costs, consumer spending, and overall economic growth. As the RBA’s next meeting approaches, Australians are anxiously awaiting potential adjustments in interest rates, especially amidst ongoing economic fluctuations.

Recent Developments

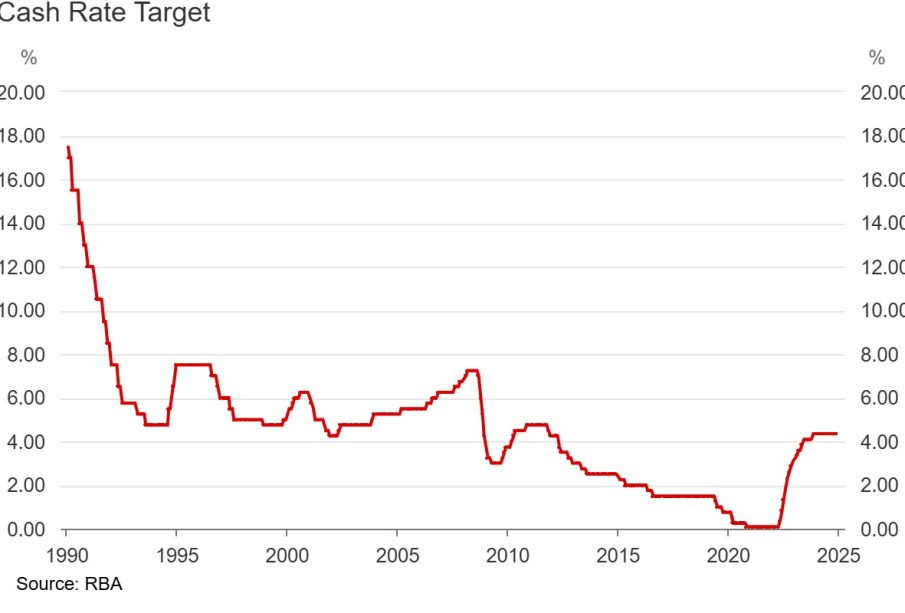

As of October 2023, the RBA has maintained a cautious approach in its monetary policy. The cash rate currently stands at 4.10%, a figure that has been influenced by inflationary pressures observed throughout the year, which reached a peak of 6.1% in June. However, inflation data has shown signs of easing, leading analysts to speculate whether the RBA will choose to maintain the current rate or consider a decrease at their upcoming meeting in November.

Inflation and Economic Indicators

According to the Australian Bureau of Statistics, the Consumer Price Index (CPI) has stabilized in recent months, indicating that inflation might be beginning to alleviate. Unemployment rates have also remained steady at 3.7%, suggesting a resilient job market, supporting the case for potential rate adjustments. Economists are keeping a close watch on these metrics as they could directly inform the RBA’s decisions.

Market Reactions

The financial markets have reacted cautiously to the speculations surrounding RBA interest rates. The Australian dollar has shown slight fluctuations, trending lower in response to concerns regarding housing affordability and consumer spending. Many analysts remain divided on whether a rate cut would stimulate the economy sufficiently without exacerbating inflationary pressures.

Conclusion: What Lies Ahead?

Looking ahead, the RBA’s decision on interest rates will be crucial not just for financial markets but also for everyday Australians managing their mortgages and personal finances. If the RBA opts to decrease rates, it may provide relief to borrowers and boost consumer confidence, fostering economic recovery. Conversely, maintaining or increasing rates could further dampen spending and slow growth. As we move closer to the RBA’s next meeting, all eyes will be on its upcoming announcements, as they will have lasting implications on the financial well-being of millions of Australians.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.