Latest Updates on BHP ASX: Market Performance and Future Trends

Introduction

BHP Group Limited, a leading global resources company, is listed on the Australian Securities Exchange (ASX) under the ticker BHP. With its extensive operations in mining and resources, BHP plays a vital role in the Australian economy and provides significant employment opportunities. Its performance on the ASX is constantly monitored by investors, economists, and market analysts, making it a crucial topic for anyone interested in the Australian stock market.

BHP’s Recent Market Performance

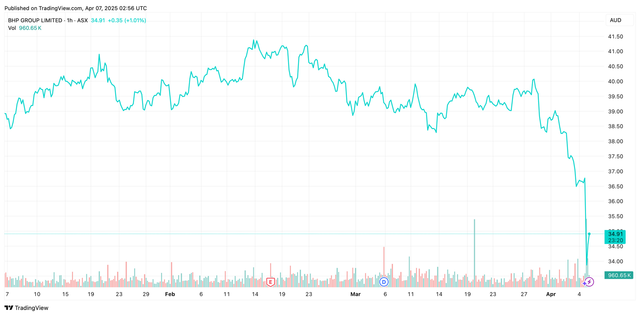

As of October 2023, BHP’s shares have shown resilience in the face of fluctuating global commodity prices. The company reported a strong fiscal year, with revenues reaching AU$60 billion, primarily driven by robust demand for iron ore and copper. Despite some challenges, including inflationary pressures and supply chain disruptions, BHP’s diversified portfolio has helped maintain investor confidence. In recent weeks, BHP’s ASX share price has risen by approximately 4%, reflecting positive market sentiment and strong quarterly results.

Key Developments and Initiatives

Recently, BHP has announced several strategic initiatives aimed at future growth and sustainability. One of the most notable is its commitment to reducing carbon emissions, aligning with global efforts to combat climate change. BHP has set ambitious targets to achieve net-zero emissions by 2050, investing heavily in renewable energy projects and green technology. Additionally, the company is enhancing its focus on its copper operations, anticipating increased demand driven by the global shift towards electrification and renewable energy systems.

Industry Challenges and Outlook

While BHP continues to perform well, several challenges lie ahead. The mining industry is facing increasing regulatory scrutiny and environmental concerns, prompting companies like BHP to adapt their operations accordingly. Furthermore, global economic uncertainties, particularly relating to China’s economic performance and demand for commodities, pose risks to BHP’s profitability. Analysts remain cautiously optimistic, predicting that BHP will continue to thrive, provided it successfully navigates these hurdles.

Conclusion

In conclusion, BHP remains a cornerstone of the ASX, significantly impacting both the local and global economies. Investors should keep a close eye on the company’s performance and strategic initiatives as it navigates an evolving marketplace. With its focus on sustainability and resilience against economic fluctuations, BHP is well-positioned for future growth. As the company continues its journey towards a greener future, its stock may present a compelling opportunity for investors interested in the mining sector.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.