Latest Update on New Zealand Reserve Bank Interest Rates

Introduction

The New Zealand Reserve Bank (RBNZ) plays a crucial role in shaping the country’s economic landscape through its monetary policy, particularly in setting interest rates. Adjusting these rates can impact inflation, consumer spending, and overall economic growth. As of October 2023, the global economy is facing various challenges, making the RBNZ’s decisions more significant than ever.

Recent Developments

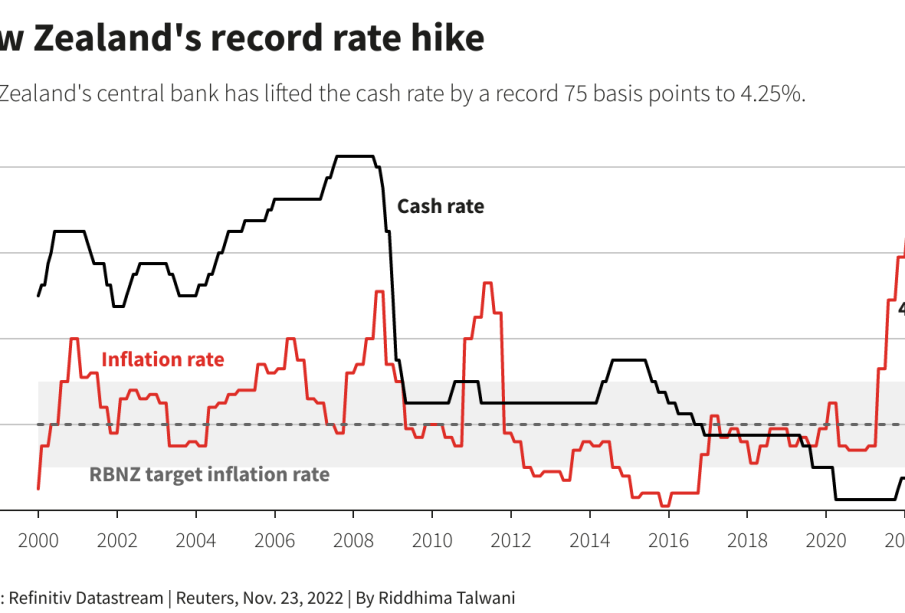

On October 25, 2023, the RBNZ announced its latest decision on the official cash rate (OCR), raising it by 25 basis points to 5.25%. This marks the seventh consecutive increase since early 2022, reflecting the bank’s continued efforts to rein in inflation, which has remained above its target range of 1-3%. Governor Adrian Orr cited persistent inflationary pressures, driven by increased commodity prices and a tight labour market, as key motivators for this decision.

The central bank had previously signalled that rising interest rates were necessary to achieve price stability and support the economy. Analysts had anticipated this increase, with many predicting further rate adjustments could follow depending on future economic indicators.

Implications for Consumers and Businesses

The interest rate hike is expected to have significant ramifications for both consumers and businesses. Mortgage rates are likely to rise, potentially impacting housing affordability and investor activity in the real estate market. Borrowing costs will increase, which may slow consumer spending, a crucial driver of New Zealand’s economy.

Businesses, particularly those relying on loans for expansion or operations, may face higher financing costs, which could dampen growth in the short term. Conversely, higher interest rates could eventually curb inflation, benefiting consumers in the long run by stabilising prices.

Conclusion

The RBNZ’s decision to raise interest rates highlights the ongoing challenges in managing economic stability. As the bank continues to navigate inflation while seeking to support growth, businesses and consumers alike must prepare for potential fluctuations in the financial landscape. Looking ahead, economists predict that the RBNZ will closely monitor inflation trends and global economic conditions to guide future monetary policy decisions, making it essential for all stakeholders to remain vigilant in this evolving economic climate.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.