Latest Update on Dow Jones Futures

Introduction to Dow Jones Futures

As one of the key indicators of the US stock market, Dow Jones futures serve as a pivotal tool for investors and analysts. Tracking the performance of major companies in the US economy, the futures can provide early insights into stock market trends before the market opens. With the ongoing volatility in global markets, understanding Dow Jones futures has become increasingly important for both seasoned investors and novices alike.

Recent Performance and Trends

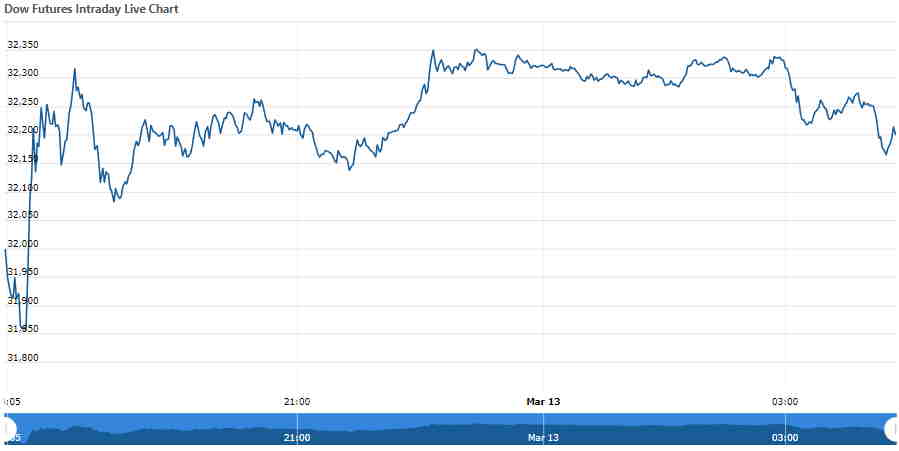

In early October 2023, Dow Jones futures experienced notable fluctuations amid rising concerns about inflation and interest rates. On October 5, futures had ticked lower by approximately 150 points, reflecting investor anxiety over the potential for further rate hikes by the Federal Reserve. Despite some initial recovery in subsequent days, market experts warn that uncertainty surrounding economic indicators may continue to influence futures trading.

According to market analysts, the implications of earnings reports from major corporations are expected to shape Dow futures in the coming weeks. Positive earnings forecasts from tech giants and retail companies could provide a boost, while disappointing earnings could lead to further declines. The upcoming earnings season is seen as a crucial period for investors looking to glean insights into the health of the US economy.

Global Factors Impacting Dow Futures

Apart from domestic economic conditions, global factors are also impacting Dow futures. The persistent conflict in Europe and fluctuating oil prices, driven by geopolitical tensions, can lead to increased volatility in stock markets worldwide. Markets are also closely monitoring fiscal policy changes in China, as the world’s second-largest economy grapples with its own economic challenges.

Conclusion and Future Outlook

As we move forward into the latter part of 2023, the outlook for Dow Jones futures remains cautiously optimistic, yet fraught with uncertainties. Investors are advised to stay informed about key economic indicators and earnings releases while being prepared for potential market reactions. Analysts suggest that the volatility in futures could risk exacerbating market reactions, making it even more crucial for traders to adopt strategies that account for economic fluctuations. With an eye towards the November elections and subsequent policies, Dow Jones futures will continue to be a barometer for market sentiment and economic health.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.