Latest Trends and Insights on NVIDIA Stock

Introduction to NVIDIA Stock

NVIDIA Corporation, known for its graphics processing units (GPUs) and artificial intelligence (AI) solutions, has become a central player in the stock market. With the increasing demand for AI technologies and gaming hardware, NVIDIA stock has gained significant attention from investors. Understanding the current market trends surrounding NVIDIA stock is essential for potential investors and tech enthusiasts alike, as it holds valuable insights into the future of technology and investment opportunities.

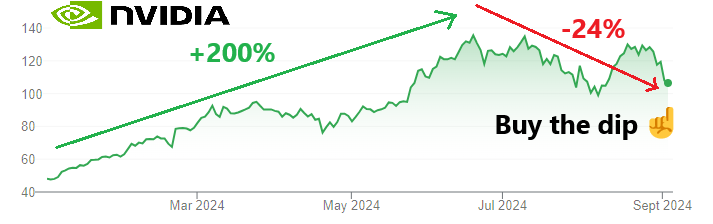

Recent Performance Highlights

As of October 2023, NVIDIA’s stock has experienced remarkable fluctuations driven by various market forces. In the past few months, NVIDIA’s shares surged due to the robust demand for AI and machine learning technologies, pushing its market capitalisation to unprecedented levels. Analysts reported that the stock is trading at around $500, significantly up from its value a year ago. Among the driving factors was the company’s recent quarterly earnings report, which surpassed expectations, showcasing impressive revenue growth and providing a forward-looking optimistic outlook.

AI and Data Center Growth

The exponential growth in AI and data processing demand has been a pivotal driver for NVIDIA’s stock performance. The company’s leadership in AI hardware, evidenced by its flagship products such as the A100 and H100 GPUs, has positioned it favorably amongst competitors. Recent partnerships with major tech firms to provide AI capabilities for cloud services have further bolstered investor confidence, making NVIDIA a core stock in tech-focused portfolios.

Market Trends and Competition

While NVIDIA leads in the GPU market, competition from companies like AMD and Intel has begun to intensify. Market experts suggest that this competition may impact NVIDIA’s margin in the coming quarters. However, NVIDIA’s continuous innovation and substantial investment in research and development are likely to maintain its leading edge in technology integration and product performance.

Conclusion and Future Projections

Anticipating the future, analysts are optimistic about NVIDIA’s stock trajectory, contingent upon ongoing advancements in AI and other technology sectors. While the stock may face volatility due to external market pressures and stiff competition, the fundamentals supporting NVIDIA’s growth remain strong. As a pivotal player in the evolving landscape of technology, NVIDIA stock remains a keen focus for both retail and institutional investors.

For investors considering entering or expanding their positions, closely monitoring NVIDIA’s quarterly earnings, market strategies, and technological advancements will be key to making informed decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.