Key Takeaways from the Latest RBA Meeting

Introduction to the RBA Meeting

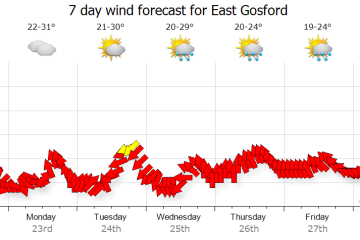

The recent Reserve Bank of Australia (RBA) meeting, held on October 3, 2023, was crucial for economists, investors, and everyday Australians as it directly influences interest rates and economic policy. The central bank’s decisions play a significant role in shaping financial conditions and provide insights into the broader economic landscape of Australia, impacting everything from mortgage repayments to business investments.

What Happened at the Meeting?

During the meeting, the RBA board decided to maintain the current cash rate at 4.10%, reiterating its commitment to the fight against inflation, which remains above the target band of 2-3%. In a statement, RBA Governor Philip Lowe noted that while inflationary pressures were easing in some sectors, it is essential to maintain a cautious approach to ensure that inflation returns to the target range.

The RBA’s decision was welcomed by many homeowners and businesses concerned about the rising cost of living. Analysts had speculated on a possible increase due to persistent inflation, but the decision to hold rates steady reflects the bank’s strategy to balance economic growth while curbing inflation. The RBA highlighted that ongoing monitoring and adjustments would be necessary depending on economic conditions.

Reactions from Analysts and Economists

Economist predictions following the meeting suggested a mixture of relief and continued caution. Some analysts argue that more rate hikes could be needed if inflation does not trend downward significantly in the coming months. Market observers believe that the RBA’s cautious approach could provide a buffer for consumer spending, which appeared to be slowing in the lead-up to the meeting.

Conclusion and Future Considerations

The significance of the RBA meeting reverberates throughout the Australian economy. Maintaining the cash rate at 4.10% indicates the bank’s resolve to ensure sustainable economic growth without exacerbating inflation. As the financial landscape remains uncertain, experts urge stakeholders to remain vigilant and flexible in their strategies moving forward. The next RBA meeting scheduled for November will be closely watched, with potential adjustments based on inflation data and economic indicators expected in the interim period.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.