Impacts of Bendigo Bank Branch Closures on Communities

Introduction

Bendigo Bank has recently announced a series of branch closures across Australia, a decision that has raised significant concern among customers and local communities alike. With the increasing shift towards digital banking, these closures reflect a broader trend in the banking industry. It is important for stakeholders to understand the implications of these changes, particularly in terms of community access to banking services and the potential economic consequences.

Details of the Closures

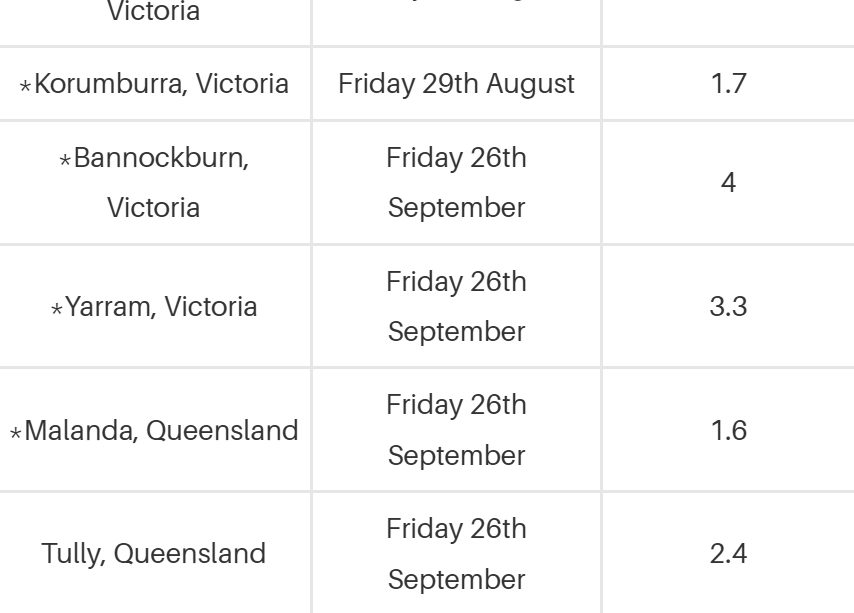

As of late September 2023, Bendigo Bank confirmed the closure of 15 branches nationally, citing the continuing decline in in-person transactions and the growing preference for online banking as key factors. The branches affected are primarily in regional areas where banking services are crucial for residents. Locations include towns such as Bairnsdale, Tumut, and Burra, all of which will see their access to face-to-face banking severely impaired.

The Australian banking industry has seen a steady decline in foot traffic as customers increasingly turn to online transactions. According to a report by the Australian Bureau of Statistics, the volume of online banking has increased by 25% over the last year alone, forcing many banks to reevaluate their operational strategies.

Community Concerns

Community leaders have voiced their frustrations regarding the closures, arguing that many residents, particularly the elderly and those without reliable internet access, depend on in-person banking services. Bendigo Bank has historically positioned itself as a community-focused institution, so the closures come as a disappointment to many loyal customers. Local councils have also expressed concern, suggesting that these changes could lead to economic decline in affected areas due to reduced foot traffic.

Looking Ahead

While Bendigo Bank insists that its decision is necessary due to changing consumer habits, this move presents several challenges. Some experts predict that as traditional branches close, banks might need to expand their digital offerings to support customers who may struggle with online banking.

Furthermore, the consequences of branch closures could prompt discussions within the banking sector about the need for alternative service models, such as partnerships with local businesses to offer banking services or mobile banking units that can visit rural areas. Stakeholders will need to monitor these developments closely and advocate for solutions that support community needs.

Conclusion

In summary, the recent Bendigo Bank branch closures highlight a significant shift in the banking landscape in Australia, with implications that reach far beyond just the bank itself. As communities grapple with the loss of access to in-person banking, the need for adaptive solutions becomes ever more critical. It remains to be seen how Bendigo Bank will address these challenges moving forward, and whether they can maintain their reputation as a community-oriented bank amidst these changes.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.