Impact of RBA Housing Market Interest Rate Cuts

Introduction

The Reserve Bank of Australia (RBA) plays a crucial role in shaping the financial landscape of the country, particularly through its influence on interest rates. Recently, the RBA has implemented interest rate cuts in response to economic challenges, aiming to stimulate the housing market. Understanding these changes is vital for potential homebuyers, investors, and those already holding property, as the rates directly impact borrowing costs and housing demand.

Current Landscape of Interest Rate Cuts

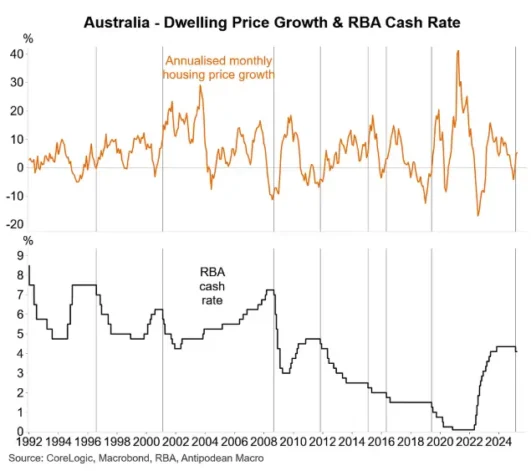

In October 2023, the RBA decided to cut the cash rate by 25 basis points, bringing it down to a record low of 3.00%. This decision followed rising concerns over inflation and economic growth, as well as the need to offer support to consumers facing financial pressure. Since the beginning of 2023, the RBA has implemented a series of cuts aimed at rejuvenating the economy. These moves have echoed throughout the housing market, prompting many first-time buyers to consider entering the marketplace.

Effects on the Housing Market

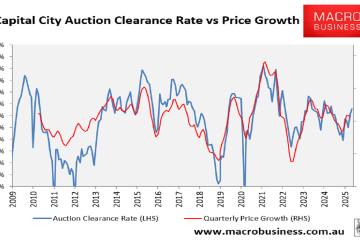

With lower interest rates, the cost of borrowing decreases significantly for prospective homeowners. According to the latest Australian Bureau of Statistics data, the housing market has started to show signs of recovery, with new housing approvals increasing by 10% in Q3 2023. Real estate analysts believe that this trend is partially fueled by the interest rate cuts, making mortgage repayments more manageable for buyers.

Additionally, the cuts have influenced investor behavior, leading to a resurgence in property investment. Reports indicate that investment housing finance rose by 15% over the same period, as investors seize the opportunity to capitalize on low borrowing costs. However, prevailing concerns over affordability and housing supply remain, indicating that while interest rates are low, challenges still exist for many buyers.

Challenges and Future Outlook

Despite the positive effects of the interest rate cuts, challenges persist in the housing market. Experts warn that while lower rates can stimulate demand, they may also exacerbate existing issues like limited housing supply and increasing property prices. The RBA’s cautious approach indicates that future cuts may depend heavily on economic performance and inflation rates.

Looking ahead, the RBA has signaled a potential stabilization of interest rates, suggesting that any future cuts will be closely monitored. Economic forecasts suggest a gradual recovery in the housing market, although it may not be uniform across all regions. Those seeking to buy or invest in property should continue to stay informed about RBA decisions and the resulting market dynamics.

Conclusion

The recent interest rate cuts by the RBA hold significant implications for the Australian housing market. As borrowing costs decrease, both home buyers and investors are encouraged to participate in a recovering market. However, ongoing challenges regarding supply and affordability highlight the complexities of the housing landscape. Stakeholders should remain vigilant as they navigate these changes, considering both the risks and opportunities that lie ahead.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.