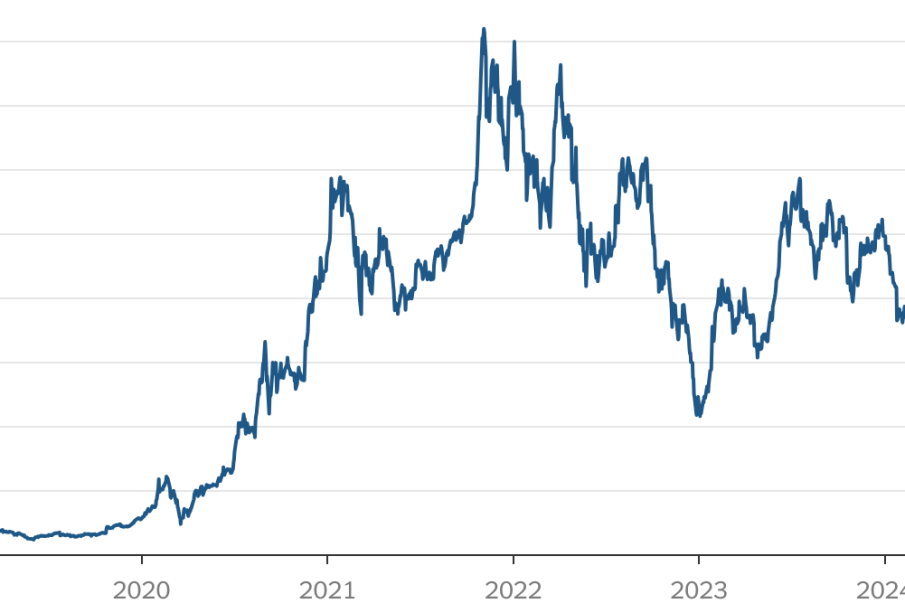

How the Tesla share price is shaping market expectations

Introduction: Why the Tesla share price matters

The Tesla share price is closely watched by investors, industry analysts and policymakers because it often reflects broader sentiment about electric vehicles, clean-energy investment and technological innovation. Movements in the stock can influence index performance, investor portfolios and funding conditions for the broader EV supply chain. Understanding the drivers behind the Tesla share price is therefore relevant to retail investors, institutional managers and consumers tracking the transition to low-emission transport.

Main body: Key factors and recent dynamics

Market drivers

Several recurring themes shape the Tesla share price. Company-specific factors include production and delivery trends, product announcements, progress on autonomous driving features, and margin performance. Broader influences include global EV demand, commodity and battery raw material costs, supply-chain resilience and competition from legacy automakers and new entrants.

Macroeconomic and regulatory context

Interest rates, inflation expectations and global growth prospects affect investor appetite for growth stocks such as Tesla. Regulatory developments—ranging from incentives for EV adoption to safety and privacy rules for driver-assistance systems—also play a significant role in framing risk and opportunity for the company and, by extension, the Tesla share price.

Volatility and investor behaviour

Tesla’s valuation has historically attracted trading volume and periods of elevated volatility. News-driven moves, commentary from analysts, and high-profile statements by company leadership can lead to rapid price swings. For short-term traders this creates opportunity and risk; for long-term investors it underscores the need to assess fundamentals and strategic positioning rather than reacting solely to daily price changes.

Conclusion: What readers should take away

The outlook for the Tesla share price depends on a mix of execution by the company, competitive developments in the EV market, and macroeconomic conditions. Possible scenarios range from continued investor enthusiasm if Tesla sustains delivery growth and margin improvement, to downward pressure if competition intensifies or macro conditions tighten. Readers should view short-term moves in the context of longer-term trends, consider diversification to manage volatility, and follow verified company reports and regulatory updates when assessing investment decisions related to the Tesla share price.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.