Fintech Innovation: How Technology Is Reshaping Financial Services

Introduction: Why fintech innovation matters

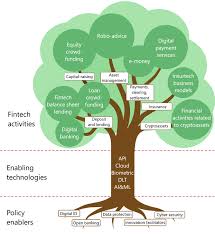

Fintech innovation is transforming how individuals and businesses manage money, access credit and engage with financial services. Its relevance spans everyday payments, small business lending, wealth management and regulatory change. As technology reduces costs and accelerates service delivery, fintech innovation has become central to competition, consumer choice and the broader economy.

Main developments and trends

Digital payments and wallets

One of the clearest outcomes of fintech innovation is the shift away from cash and traditional card transactions towards digital wallets, contactless payments and peer-to-peer payment apps. These solutions focus on speed, convenience and security, helping merchants and consumers transact with minimal friction.

Open banking and data-driven services

Open banking is enabling consumers to share financial data securely with third-party providers, supporting personalised financial advice, account aggregation and streamlined switching between banks. Fintech innovation in this area aims to increase transparency and competition, allowing consumers to access services better tailored to their needs.

Investment platforms and automated advice

Robo-advice, micro-investing and platform-based wealth services have widened access to investment opportunities. By automating portfolio construction and lowering minimums, fintech innovation is making wealth management more accessible to a broader population while emphasising user experience and cost efficiency.

Regtech and security

With increased digitisation comes a focus on regulatory technology (regtech) and cybersecurity. Fintech innovation includes tools for identity verification, fraud detection and regulatory compliance that help firms manage risk while meeting regulatory obligations.

Challenges and adoption

While fintech innovation brings benefits, it also raises challenges around privacy, digital exclusion and the need for clear regulation. Adoption depends on consumer trust, interoperability between systems and ongoing collaboration between financial institutions, startups and regulators.

Conclusion: Outlook and significance for readers

Fintech innovation will continue to shape how people interact with money and financial services. For consumers, this means greater choice and convenience; for businesses, new channels and competitive pressures. Staying informed about developments, focusing on security and considering how new services fit individual needs will help readers make the most of fintech-driven opportunities.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.