Exploring the Nasdaq 100: Key Insights for Investors in 2023

Introduction to the Nasdaq 100

The Nasdaq 100 is a stock market index comprising 100 of the largest non-financial companies listed on the Nasdaq stock exchange. Established in 1985, it provides a significant insight into the performance of major technology and biotechnology firms that are driving innovation and market trends. As of 2023, understanding the Nasdaq 100 is crucial for investors and analysts alike, given its substantial influence on the global economy.

Current Composition and Key Players

In 2023, the Nasdaq 100 includes giants like Apple, Microsoft, Amazon, and Alphabet, which together make up a significant portion of the index’s market capitalisation. This concentration in technology indicates a shift towards a digital-driven economy, echoing the increasing importance of tech innovations in everyday life, especially following the pandemic.

The index reflects the dynamics of high-growth sectors, including information technology, consumer services, and healthcare. Notably, in recent months, the performance of companies such as NVIDIA and Tesla has underscored the volatility inherent to tech stocks; while they often experience significant upswings, sharp declines are also common.

Recent Trends and Economic Impact

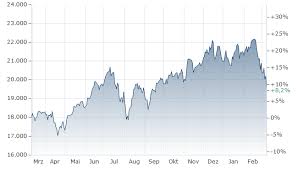

Throughout 2023, the Nasdaq 100 has shown resilience despite global economic uncertainties, such as inflationary pressures and geopolitical tensions. After experiencing fluctuations earlier in the year, the index regained momentum, driven by strong earnings reports and advancements in AI technology, particularly in companies involved in cloud computing and machine learning.

Recent investments in green technology and biotechnology are also reshaping the landscape of the Nasdaq 100, bringing new opportunities for growth. Investors are keenly watching how these sectors perform, noting that the shift towards sustainability will likely play a key role in shaping future market conditions.

Conclusion: What Lies Ahead for the Nasdaq 100?

Looking forward, analysts anticipate that the Nasdaq 100 will continue to evolve with emerging technologies and changing consumer behaviours. The volatility witnessed in tech stocks calls for a cautious approach from investors, highlighting the necessity of diversifying portfolios to mitigate risk. As the index resumes its upward trajectory, understanding its components will be vital for making informed investment decisions.

In conclusion, the Nasdaq 100 is not just a barometer of tech prowess; it is a reflection of how the modern economy is shaped by innovation and adaptability. For Australian investors and those globally, keeping an eye on this index will be essential for navigating the complexities of today’s financial markets.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.