Everything You Need to Know About Mortgage Quotes

Introduction

In the evolving landscape of the Australian housing market, understanding the nuances of mortgage quotes is essential for prospective homebuyers. A mortgage quote provides a preliminary estimate of the cost you will incur to finance your property through a loan. This quote is critical not only for budgeting purposes but also for comparing offers from different lenders, which can affect both the affordability of your home and the financial commitment over time.

What is a Mortgage Quote?

A mortgage quote is an estimate provided by lenders detailing how much they are willing to lend you, including the interest rate, estimated monthly repayments, and any fees involved. It typically includes information on the loan type, term length, and conditions you need to meet for approval. Mortgage quotes can vary significantly between lenders, emphasizing the need for prospective buyers to shop around.

How to Obtain a Mortgage Quote

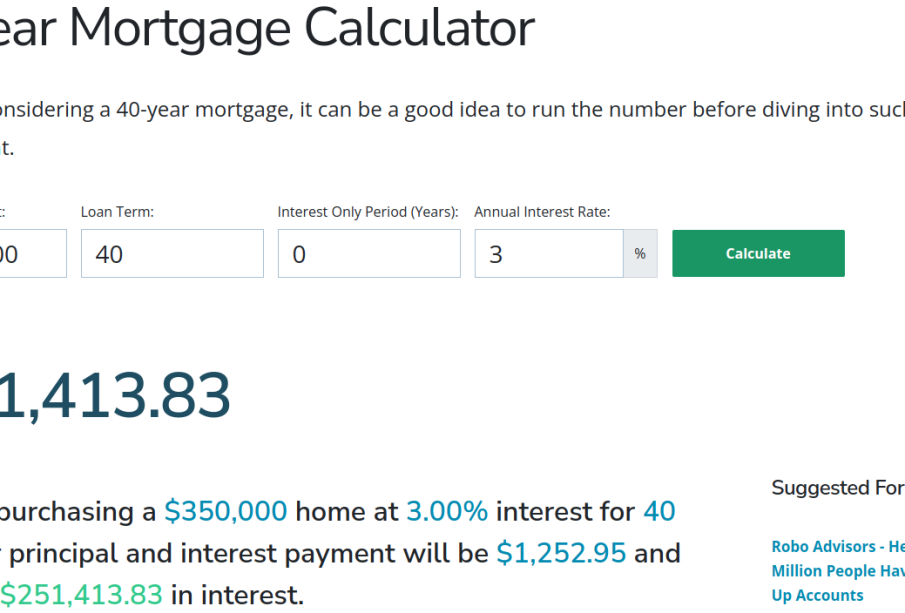

Obtaining a mortgage quote has become simpler with the advent of digital platforms. Homebuyers can use online calculators or contact lenders directly to request quotes. It is advisable to have relevant financial information on hand, such as your income, debts, and credit score, as lenders will need this data to provide a more accurate estimate. Moreover, it is crucial to compare quotes from various lenders to ensure you are getting the best possible deal.

Current Trends in Mortgage Quotes

As of late 2023, the Australian housing market is experiencing fluctuations due to economic factors such as changing interest rates and inflation concerns. The Reserve Bank of Australia has been adjusting rates to manage economic growth, which significantly impacts mortgage quotes. Recent data shows that the average rate for new home loans has risen, making it even more essential for homebuyers to understand their mortgage quotes deeply and consider fixed versus variable rates based on their financial situations.

Conclusion

Mortgage quotes play a pivotal role in the home-buying process, offering valuable insights into potential borrowing and repayment scenarios. As the housing market continues to evolve, staying informed about mortgage quotes and leveraging competitive offers from various lenders will aid Australians in making better financial decisions. Engaging with financial advisors and utilizing online tools can further empower buyers in navigating their mortgage journey, thus ensuring they secure the most favorable financing terms available.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.