Current Trends in Nike Share Price: What Investors Should Know

Understanding the Importance of Nike Share Price

Nike Inc. (NKE), a major player in the global sportswear market, has seen its share price fluctuate considerably over the years, making it a vital indicator for investors and analysts alike. As of October 2023, Nike continues to be a company of interest due to its innovative product lines and robust marketing strategies.

Recent Developments Affecting Nike Share Price

In recent months, several factors have influenced Nike’s share price. After reporting its last quarterly earnings, Nike’s stock experienced a notable surge, attributed to increased direct-to-consumer sales and a resurgence in demand following the easing of pandemic restrictions. The company’s ability to adapt to changing retail landscapes has captured investor confidence.

Additionally, ongoing partnerships with prominent athletes and expansion into new markets, including e-commerce ventures, have also bolstered expectations. According to market analysts, Nike has emphasized sustainability in their practices, which resonates with environmentally conscious consumers. The company aims to achieve significant sustainability goals by 2025, enhancing its brand appeal.

Current Market Trends and Analysis

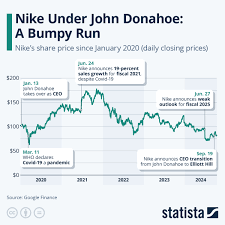

As of October 2023, Nike’s share price hovers around AUD 130, reflecting a year-to-date growth of approximately 15%. Analysts forecast potential growth moving forward, owing to continued consumer interest and recovery in sports activities post-pandemic. The Sportswear market is projected to grow further, with Nike positioned to capitalize on emerging trends.

However, investors should remain cautious. Market analysts indicate that inflation and global supply chain issues could impact production costs, thereby influencing future profits. Any adverse changes in consumer spending patterns, particularly in discretionary spending, could also affect share price stability.

Conclusion: What This Means for Investors

In conclusion, Nike’s share price reflects not only the company’s health but also broader trends in the retail and sports sectors. For investors, it’s crucial to monitor various dynamics, including global economic conditions and consumer preferences. As Nike adapts to the evolving market, the company remains a significant entity to watch. Investors should conduct thorough research before making decisions, as several variables could influence volatility in the coming months. Keeping an eye on Nike’s strategic moves will be essential for predicting its future performance in the stock market.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.