Current Trends in Copper Price in Australia

The Importance of Copper Price

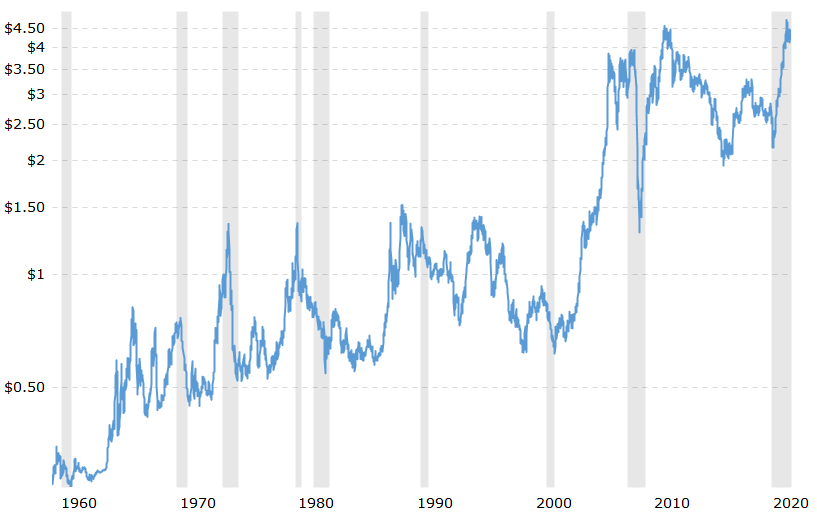

Copper has long been regarded as a critical metal in various sectors, including construction, electrical, and technology. Recent increases or fluctuations in the copper price can have significant implications for both the Australian economy and global market trends. With Australia’s status as one of the world’s leading producers of copper, understanding its price dynamics is essential for investors, businesses, and policymakers alike.

Recent Developments

As of October 2023, copper prices have seen a resurgence following a period of volatility earlier in the year. The London Metal Exchange (LME) reported that the average copper price reached AUD 10,500 per tonne in recent weeks, influenced by several factors including increased demand from China, supply chain disruptions, and production cuts by major mining companies.

The demand from China, the world’s largest consumer of copper, has been bolstered by its ongoing urbanisation projects and renewable energy initiatives. These factors boost the demand for copper, predominantly used in electrical wiring and infrastructure development.

Supply Chain Factors

On the supply side, major copper-producing countries such as Chile and Peru have faced challenges like strikes and operational setbacks due to adverse weather conditions. Australia, while not facing as many immediate challenges, has also seen a slight decline in production efficiency which impacts overall availability.

Future Forecasts

Looking ahead, analysts are optimistic about copper price trends, with predictions suggesting that prices could remain elevated due to persistent demand in the renewable energy sector. According to a recent report from ANZ Research, copper could see prices stabilize around AUD 11,000 to AUD 12,000 per tonne by mid-2024 if demand continues on its current trajectory.

Conclusion and Significance

For businesses relying on copper for their products or services, the current price trends necessitate strategic planning and procurement strategies. Investors considering the copper market will need to remain vigilant about global economic indicators and geopolitical factors that could influence supply and demand. Overall, monitoring copper prices is more than just following market trends; it is crucial for understanding and navigating the broader economic landscape in Australia and beyond.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.