Current Trends in CBA Share Price: Insights for Investors

Introduction

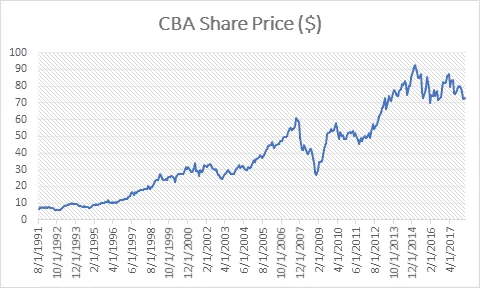

The Commonwealth Bank of Australia (CBA) is one of the country’s leading financial institutions, and its share price is of great interest to investors and analysts alike. The movement of CBA’s share price can reflect broader economic conditions, banking sector trends, and investor confidence. Understanding the current state of CBA’s share price is crucial for making informed investment decisions.

Current Share Price Movements

As of mid-October 2023, CBA’s share price is being closely monitored after experiencing significant fluctuations over the last few months. Recently, the shares closed at approximately AUD 98.50, representing an increase of about 5% compared to the previous quarter. Analysts attribute this positive movement to stronger-than-expected quarterly earnings released by the bank, which reflected a robust recovery in loan growth and improvements in net interest margins.

Factors Influencing CBA’s Share Price

Several factors influence CBA’s share price, including interest rate changes, regulatory policies, and economic indicators such as GDP growth. The Reserve Bank of Australia’s decisions on interest rates play a crucial role, particularly given the current context of rising borrowing costs. Recent indicators reveal that the Australian economy shows signs of resilience despite global uncertainties, contributing positively to banking stocks.

Furthermore, the geopolitical landscape and global market volatility can impact investor sentiment. With ongoing concerns about inflation and potential recessions in various economies, CBA’s management remains focused on risk mitigation while strategically expanding its global footprint.

Market Sentiment and Future Outlook

Investor sentiment towards CBA now appears optimistic, bolstered by the bank’s strong performance and proactive risk management strategies. Market analysts forecast that in the upcoming months, CBA’s share price could continue to benefit from increasing demand for financial services as economic conditions stabilise. However, potential headwinds such as competitive pressures and international market fluctuations are also being watched closely.

Conclusion

In conclusion, the CBA share price is a significant indicator of both the bank’s individual performance and the health of the Australian financial sector. For investors, staying updated on CBA’s share price fluctuations and understanding the underlying factors will be crucial in navigating their investment strategies moving forward. Whether CBA’s share price trend holds steady or experiences further volatility, it’s essential for investors to maintain vigilance in a changing marketplace.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.