Current Trends in CBA Share Price

Introduction

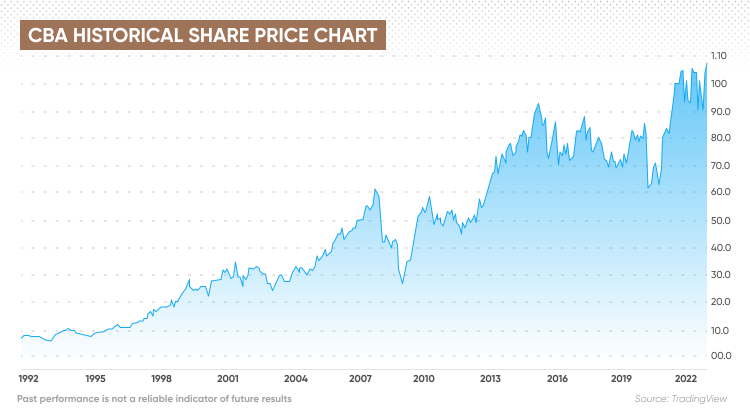

The Commonwealth Bank of Australia (CBA) is not only one of the country’s largest banks but also a significant player on the Australian Securities Exchange (ASX). Understanding the CBA share price trends is crucial for investors and financial analysts alike, as it reflects broader economic conditions, investor sentiment, and the bank’s operational performance. As of late 2023, numerous factors have influenced the CBA’s share price, making it an important topic of discussion.

Recent Performance and Factors Affecting the Share Price

As of October 2023, the CBA share price has seen fluctuations influenced by a variety of elements, including interest rate changes, macroeconomic indicators, and the bank’s quarterly financial results. Recently, the Reserve Bank of Australia (RBA) opted for a pause in interest rate hikes, which has generally been well-received by markets. Analysts noted that this decision provides a more stable environment for consumers and businesses, which can positively affect the banking sector.

Additionally, during the recent quarterly earnings report, CBA reported a 7% increase in net profit year-on-year, which helped lift investor confidence. The strong performance in home loan growth and fee income from financial services has been a significant driver behind the share price’s resilience. However, potential global economic challenges, including a looming recession in some sectors around the globe, pose risks to future growth.

Market Sentiment and Future Outlook

The general market sentiment around CBA’s share price remains cautiously optimistic. Analysts foresee that while short-term volatility may continue due to both domestic and international factors, the bank’s strong fundamentals should provide some level of protection against severe downturns. Furthermore, any upcoming Federal Government policies aimed at stimulating the economy could also bolster the performance of CBA shares.

Investors are advised to keep a close eye on both global economic developments and the Australian market’s reactions. With the approach of new financial year budgets and fiscal policies, these factors will be crucial for projecting the share price trajectory in the coming months.

Conclusion

In conclusion, the CBA share price remains a critical indicator for investors navigating the Australian banking sector. With recent positive earnings and a supportive interest rate environment, there are signs of optimism. However, vigilance is necessary as external factors could influence market performance. Understanding these trends will be vital for investors looking to make informed decisions regarding their portfolios.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.