Current Trends Impacting Tesla Share Price

The Importance of Tesla’s Share Price

The stock price of Tesla, Inc. is a critical indicator of the company’s performance and investor sentiment. As one of the leading electric vehicle manufacturers globally, fluctuations in Tesla’s share price affect not only shareholders but also the broader electric vehicle market and environmental sustainability efforts. Understanding the factors behind these changes is essential for potential investors and market analysts alike.

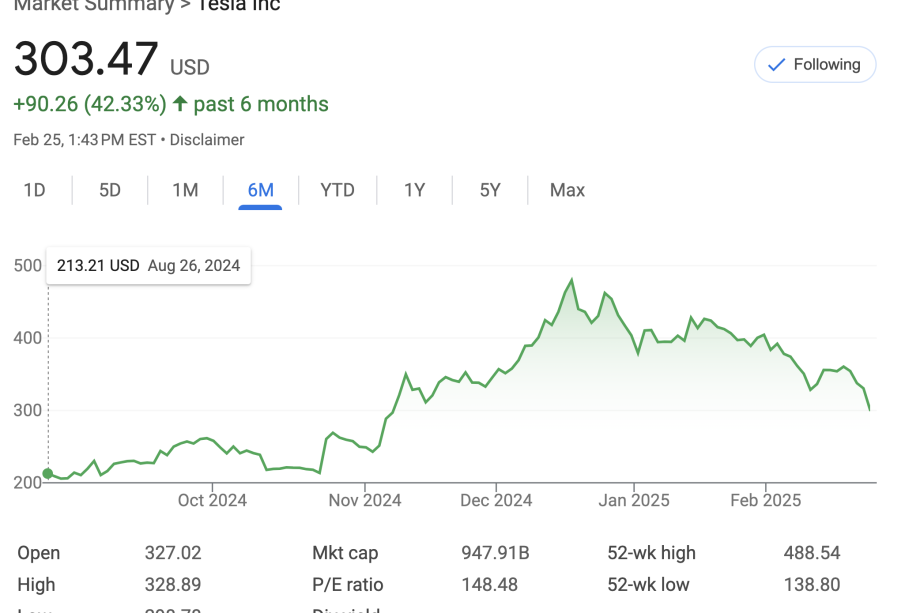

Recent Trends in Tesla’s Share Price

As of October 2023, Tesla’s share price has shown significant volatility. After reaching an all-time high of $314 per share in late 2022, the stock has experienced fluctuations due to various internal and external factors. As of mid-October 2023, the share price is trading around $245, reflecting a decrease that has raised concerns among investors. Analysts attribute this decline to several factors, including economic uncertainties, rising interest rates, and increased competition in the electric vehicle market.

Factors Affecting Tesla’s Share Price

1. **Market Competition**: Tesla faces growing competition from established automakers and new entrants launching electric vehicles. Major brands like Ford, Chevrolet, and Volkswagen are ramping up production of electric vehicles, influencing market share and investor confidence in Tesla.

2. **Production and Supply Chain Issues**: Tesla has been working to refine its manufacturing processes and address supply chain challenges. Recent reports indicate that while production rates have increased, ongoing supply chain disruptions, partly due to global semiconductor shortages, may continue to impact Tesla’s ability to meet consumer demand effectively.

3. **Economic Conditions**: Global economic conditions, including inflation and interest rate hikes, significantly impact consumer purchasing power and investment decisions. The Federal Reserve’s tightening measures have made it more expensive for consumers to finance vehicle purchases, potentially leading to decreased demand for Tesla’s vehicles.

Looking Ahead

Considering these factors, analysts predict a cautious outlook for Tesla in the short term. Market sentiment indicates that if Tesla can successfully navigate the competitive landscape and effectively manage production challenges, there could be potential for recovery in its share price. Industry experts are keeping a close eye on upcoming quarterly earnings reports, which may provide further insights into Tesla’s financial health and strategy moving forward.

In conclusion, while the current Tesla share price reflects several challenges facing the company, its long-term growth potential remains significant. Investors should remain informed about market trends and company developments to make educated decisions regarding their investments.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.