Current Trends and Insights on Tesla Share Price

Introduction

The Tesla share price remains a focal point for investors and market analysts alike due to its volatility and significant impact on the stock market. As one of the leading electric vehicle manufacturers, Tesla’s stock performance is indicative of broader trends in the automotive sector as well as renewable energy markets. Understanding the factors influencing Tesla’s share price can provide valuable insights for potential investors.

Recent Developments Affecting Tesla Share Price

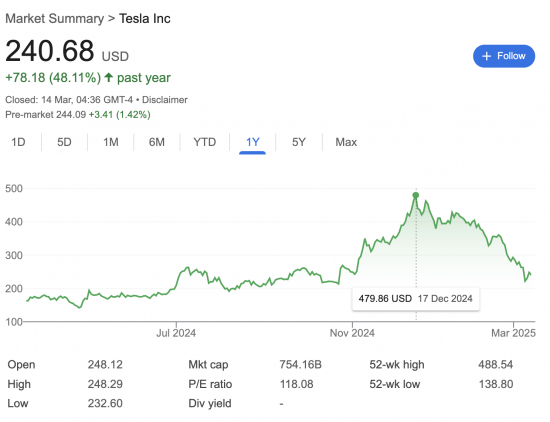

Tesla’s share price has seen notable fluctuations in recent months, influenced by various factors including production milestones, delivery numbers, and broader economic indicators. As of October 2023, the share price has recovered from a slump earlier in the year, currently trading around AUD 245, showing resilience despite challenges such as supply chain disruptions and intense competition from other electric vehicle manufacturers.

Recent quarterly earnings reports revealed better-than-expected profits, driven by increased demand for the Model Y and a successful rollout of the Cybertruck. This has boosted investor confidence, leading to a rise in share price. Additionally, Tesla’s foray into AI with its Full Self-Driving software and robust energy solutions has fortified its market reputation, keeping the stock attractive to investors.

Market Analysts’ Perspectives

Market analysts suggest that Tesla’s share price is likely to remain volatile in the near term due to the overall economic environment, including inflation concerns and interest rate fluctuations. However, bullish forecasts remain prevalent, with some experts projecting significant growth as Tesla expands its product line and strengthens its manufacturing capabilities globally.

Furthermore, the company’s commitment to innovation in battery technology and renewable energy solutions is expected to keep it ahead in the competitive landscape, further supporting its share price. Analysts are particularly optimistic about Tesla’s new factories overseas, which are expected to enhance production efficiency and reduce costs.

Conclusion

The Tesla share price is not just a reflection of the company’s immediate financial health but also a barometer of the larger trends in the electric vehicle and renewable energy markets. Whilst factors such as market competition and economic conditions can introduce volatility, Tesla’s strategic initiatives and innovation-driven culture position it for long-term growth. For investors, understanding these dynamics is crucial for making informed decisions regarding Tesla shares.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.