Current Trends and Future Outlook for Amazon Stock

Introduction

Amazon stock has been a focal point for investors, financial analysts, and market enthusiasts throughout 2023. As a major player in e-commerce and cloud computing, its stock performance not only reflects the company’s operational success but also indicates broader technology sector trends. Understanding the movements of Amazon’s stock is crucial for potential investors looking to navigate the tumultuous financial landscape.

Recent Performance

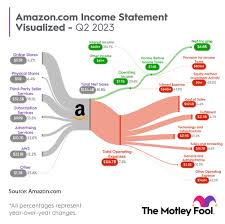

As of October 2023, Amazon’s stock price has shown significant fluctuations, reflecting various market dynamics. Following a substantial dip earlier in the year during a broader market correction, Amazon shares have rebounded sharply, rising approximately 25% over the last few months. Investors reacted positively to the company’s latest earnings report, which revealed stronger-than-expected revenue growth, fueled by an increase in its cloud services (AWS) and a resurgence in online retail sales.

Key Factors Influencing Amazon Stock

Several key factors have contributed to the recent performance of Amazon’s stock. Firstly, the ongoing expansion and innovation within Amazon Web Services (AWS) have provided a solid revenue stream. The company has been actively investing in artificial intelligence, which is now a critical growth area, attracting significant corporate clients and partnerships.

Moreover, the overarching economic environment, including inflation rates and consumer spending patterns, has influenced investor confidence. Analysts have noted that Amazon is adapting its business model to focus more on profitability rather than merely top-line growth, a shift that has garnered attention from shareholders looking for stability.

Market Sentiment and Future Outlook

Investor sentiment regarding Amazon stock remains cautiously optimistic. With industry analysts projecting continued growth in both e-commerce and cloud services, Amazon is often viewed as a resilient stock with substantial upside potential. Nevertheless, challenges such as increased competition, regulatory scrutiny, and economic uncertainties persist, which could impact its stock performance moving forward.

Conclusion

In conclusion, Amazon stock is positioned within a complex interplay of market forces and company-specific advancements. While the recent trend indicates a positive trajectory, potential investors should remain aware of the inherent risks and market volatility. As Amazon continues to innovate and expand, resourceful investors can leverage insights about its stock performance to make informed decisions in a competitive market.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.