Current Trends and Analysis of CBA Share Price

Introduction

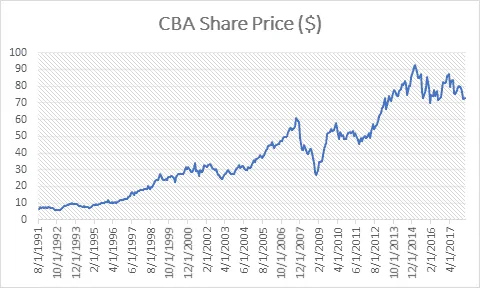

The Commonwealth Bank of Australia (CBA) is one of the largest financial institutions in the country and serves as a significant indicator of economic performance in Australia. The fluctuation in CBA’s share price is closely monitored by investors, financial analysts, and the general public. As of October 2023, the CBA share price has been showing notable trends that merit analysis and discussion.

Current Performance of CBA Share Price

As of the latest trading reports, the CBA share price is experiencing volatility due to various factors including interest rate changes, economic conditions, and market sentiment. In September 2023, the stock saw a weekly high of AUD 100, driven by strong quarterly earnings that exceeded analysts’ expectations.

However, following the announcement of potential regulatory changes in the banking sector, the share price dipped briefly in early October but has since stabilised as investors reassess the long-term prospects of the bank. Analysts attribute this stability to the bank’s robust fundamentals and effective risk management practices.

Factors Influencing Share Price Movements

Several external and internal factors influence the CBA share price. Economic indicators, such as GDP growth, employment rates, and consumer spending, impact investor confidence. Additionally, market conditions, global economic uncertainty, and fluctuations in interest rates from the Reserve Bank of Australia (RBA) play critical roles in determining the stock’s price.

Furthermore, competitors in the banking sector and investor sentiment, particularly during earnings season, can also lead to significant price shifts. Recently, comments from RBA officials regarding monetary policy have heightened market speculation, contributing to share price volatility.

Future Outlook

Looking ahead, analysts remain cautiously optimistic about the CBA share price. With the Australian economy showing signs of resilience, predictions for the upcoming quarters suggest a potential rebound, supported by anticipated growth in lending and improving consumer confidence.

However, it is essential for investors to consider the ongoing risks, including global economic factors and changes in national regulatory policies, which can create headwinds for share performance. Given these dynamics, a watchful eye on market trends will be crucial for stakeholders moving forward.

Conclusion

The CBA share price is a vital barometer for not just the bank, but for the Australian economy as a whole. As trends evolve, staying informed and agile in investment strategies will be key for those interested in capitalising on potential movements. Investors are encouraged to undertake thorough research and consult financial professionals when considering investments tied to CBA share price.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.