Current Status of the ASX200 and Its Economic Implications

Introduction to the ASX200

The ASX200, or the S&P/ASX 200, is a stock market index that represents the 200 largest publicly traded companies on the Australian Securities Exchange. It is widely viewed as a barometer of the Australian economy and is highly influential among investors and financial analysts. Understanding the ASX200 is essential for anyone interested in the Australian financial landscape.

Current Situation of the ASX200

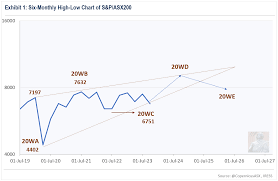

As of late October 2023, the ASX200 has shown notable resilience despite ongoing global economic uncertainty. The index closed at approximately 7,250 points, reflecting a year-to-date increase of around 8%. This increase can be attributed to several factors, including stronger-than-expected corporate earnings reports and renewed investor confidence in key sectors such as mining, technology, and healthcare.

Recent Developments

In recent weeks, several companies listed in the ASX200 have released third-quarter earnings reports indicating robust performance. Notably, leading mining companies such as BHP and Rio Tinto reported higher revenues driven by increased demand for minerals and commodities from Asia. Meanwhile, tech giants like Afterpay and Xero have continued to thrive, showcasing significant growth amidst digital transformation trends.

Additionally, economic data released by the Australian Bureau of Statistics (ABS) indicates a steady recovery in consumer spending and employment rates, which has positively impacted investor sentiment regarding the index. However, inflation concerns still linger, as the Reserve Bank of Australia (RBA) adjusts interest rates in response to changing economic conditions.

Comparison with Global Markets

When compared to global peers such as the S&P 500 in the United States and the FTSE 100 in the UK, the ASX200 has shown a strong performance, especially in the resource sector. Some analysts argue that Australia’s natural resource wealth provides a buffer against potential economic downturns in other parts of the world.

Conclusion and Future Outlook

The outlook for the ASX200 appears cautiously optimistic as we move towards the end of 2023. Analysts predict that continued corporate earnings growth and a stabilising economy may push the index higher, potentially crossing the 7,500 points mark in the coming months. However, risks such as inflation volatility and geopolitical tensions remain. Investors are encouraged to stay informed and consider these factors when making investment decisions related to the ASX200. Understanding these dynamics will not only enhance their investment strategies but also foster a broader comprehension of the Australian economic climate.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.