Current Insights on Woolworths Share Price

Introduction: Importance of Woolworths Share Price

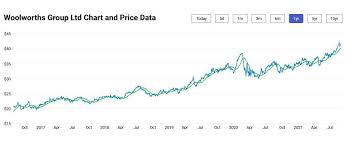

The Woolworths share price is a key indicator for investors who follow the Australian stock market. As one of Australia’s largest supermarket chains, Woolworths plays a crucial role in the economy and influences the retail sector. Understanding its share price trends provides insights not only into the company’s financial health but also into broader market conditions.

Recent Trends and Events

As of October 2023, Woolworths shares have shown fluctuations amid various economic factors. The current share price stands at AUD 35.60, reflecting a steady performance compared to the previous month. Analysts attribute this stability to Woolworths’ consistent sales growth and strong customer loyalty, which have been reinforced during recent economic uncertainties.

Several factors have influenced the recent movements in Woolworths’ share price. For one, the company recently reported a 4.5% increase in quarterly sales, driven by an uptick in grocery demand. Despite challenges such as rising inflation and supply chain disruptions, Woolworths has managed to maintain its market position effectively.

Financial Performance and Future Expectations

In its latest earnings report, Woolworths demonstrated robust financial health, with a reported profit of AUD 1.5 billion for the last fiscal half. This aligns with market expectations and has played a role in reinforcing investor confidence. Furthermore, the company has announced a dividend return to shareholders, which analysts see as a positive sign of confidence in the company’s ongoing strategy.

Looking ahead, analysts forecast that Woolworths will continue to adapt to evolving consumer behaviour, particularly in the digital shopping space. The growing trend towards e-commerce is expected to boost sales further, contributing positively to share price developments.

Conclusion: Significance for Investors

For potential investors, monitoring the Woolworths share price is essential as it provides significant insights into the company’s performance and the health of the retail market in Australia. The current stability and projected growth suggest that Woolworths remains a solid investment choice. However, as market conditions continue to evolve, particularly in response to economic factors such as inflation and consumer spending patterns, staying informed will be crucial for making investment decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.