Current Insights into Tesla Share Price Trends

Introduction to Tesla Share Price

The Tesla share price is a topic of great interest for investors and financial enthusiasts alike. As one of the leading players in the electric vehicle industry, Tesla’s stock performance reflects not just the company’s operational success, but also larger market trends and consumer sentiment towards sustainability. Understanding the nuances of Tesla’s share price is crucial for making informed investment decisions in today’s rapidly evolving market.

Recent Trends and Events Influencing Tesla’s Stock

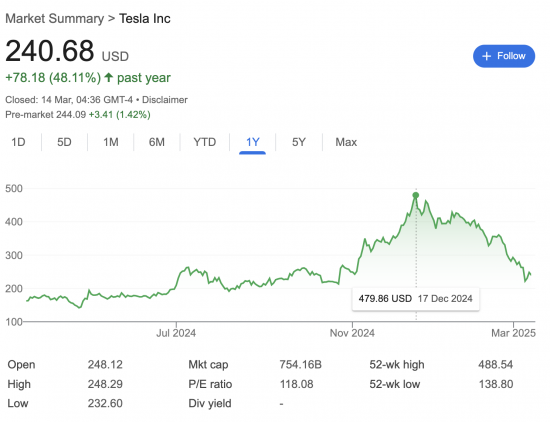

As of October 2023, Tesla’s share price has experienced significant fluctuations, impacted by various factors. In September 2023, Tesla announced its Q3 earnings report, exceeding analyst expectations with a revenue of $22.4 billion, which represented a year-on-year increase of 22%. This robust performance triggered a temporary surge in share prices, reaching a high of $275 per share. However, a recent shift in global economic conditions and rising interest rates have led to a correction, with shares currently trading around $245, reflecting a decline of approximately 10% from peak levels.

Market Analysis and Future Projections

Analysts are divided in their projections for Tesla’s future. Many cite the company’s strong order backlog and global expansion efforts as bullish indicators. Furthermore, Tesla’s continued innovation in battery technology and autonomous driving features could bolster its market position. On the other hand, concerns about increased competition from traditional automakers pivoting to electric vehicles and potential regulatory challenges could put downward pressure on the share price. Investment firms are cautious, with several reiterating a “hold” rating in light of the current market uncertainty.

Conclusion: What’s Next for Tesla’s Share Price?

For investors, the Tesla share price remains a significant metric to monitor. The company’s focus on scalability, sustainability, and technological advancement provides a strong foundation, yet external factors such as economic conditions, production capabilities, and market competition will continue to influence stock performance. As we approach the end of the fiscal year, market watchers will closely watch both Tesla’s strategic decisions and macroeconomic indicators to gauge the future trajectory of the share price.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.