CSL Share Price: Recent Trends and Market Insights

Introduction

The CSL share price is a critical metric for investors in the biotechnology and pharmaceuticals sector, reflecting the company’s financial health and market perception. As a major player in the Australian stock market, CSL Limited’s performance is closely monitored by analysts and retail investors alike. Understanding the recent trends in the CSL share price is vital for anyone looking to invest or keep their portfolio updated.

Recent Developments

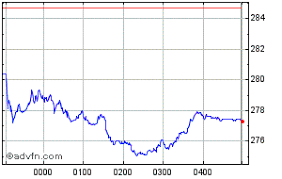

As of late October 2023, CSL Limited’s share price has experienced notable fluctuations due to various factors affecting the pharmaceutical industry. As of October 27, CSL shares were trading around AUD 300, following a drop of approximately 5% over the past month. This decline has raised concerns among investors, primarily driven by several key events, including global supply chain disruptions and changing regulatory landscapes.

Moreover, CSL recently announced its quarterly earnings, revealing a 10% year-over-year increase in revenue. However, this positive earnings report was overshadowed by concerns regarding anticipated drops in demand for certain plasma-derived therapies due to changes in treatment guidelines. The combination of these factors has led to a mixed sentiment in the market.

Market Analysis

Analysts attribute the fluctuation of the CSL share price to pressure from broader economic conditions including inflation rates and interest rates, which affect investment across sectors. In addition to macroeconomic variables, CSL’s position within the biotechnology segment, a field known for rapid advancements and regulatory scrutiny, brings its own challenges. Simple market sentiment shifts can trigger significant volatility, impacting shareholder confidence.

Conclusion

The CSL share price remains a focal point for many investors as it encapsulates both the company’s solid fundamentals and the external pressures of the market environment. With potential recovery mechanisms underway and adaptations to new market conditions being explored, the outlook for CSL appears cautiously optimistic. Analysts recommend that investors keep a close eye on CSL’s strategic moves and regulatory changes in the healthcare sector to gauge future performance. Understanding these dynamics will prove indispensable for making informed investment decisions in the coming months.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.