CSL ASX: Innovations in Biotechnology and Its Market Impact

Introduction

CSL Limited, trading on the Australian Securities Exchange (ASX) under the ticker symbol CSL, stands as a beacon of innovation in the biotechnology sector. Founded in 1916, CSL has evolved from its origins as a government-owned enterprise to one of the largest and most successful biopharmaceutical companies globally. Its significance extends beyond the confines of the ASX, as its operations contribute to global health initiatives and advancements in therapeutics.

Recent Developments

As of late 2023, CSL has made headlines with its latest financial results, showcasing a robust growth trajectory. The company reported a revenue increase of 12% year-on-year, driven largely by its immunoglobulin therapies and the launch of new products in its portfolio. This performance is noteworthy given the ongoing global shifts in healthcare demand, particularly amid lingering effects from the COVID-19 pandemic.

Moreover, CSL’s strategic acquisition of the US-based company, Vifor Pharma, has bolstered its capabilities in iron deficiency treatments. This acquisition, completed in 2022, has positioned CSL to effectively address a critical area of unmet medical need, further driving its market share and profitability.

Market Performance and Investor Insights

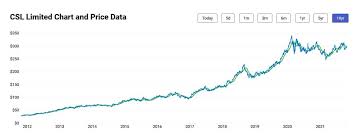

On the ASX, CSL’s share price has demonstrated resilience, even amidst fluctuations in market sentiment. As of now, CSL’s shares are trading around AUD 300, reflecting a steady increase over the past year. Analysts have given it a ‘buy’ rating, citing strong growth prospects and the company’s historical performance.

Investors are particularly optimistic about CSL’s research and development pipeline, which includes innovative therapies targeting various chronic conditions and rare diseases. CSL invests heavily in R&D, with a commitment of approximately 10% of its revenue towards this vital area, showcasing its dedication to innovation.

Conclusion

CSL’s stature as a leader in biotechnology on the ASX cannot be overstated. With its continued investment in research, robust financial performance, and strategic acquisitions, CSL is well-positioned to navigate the challenges of the healthcare landscape and deliver value to stakeholders. Looking ahead, analysts predict that CSL will not only maintain its market position but may also expand its influence as global health demands evolve.

For investors and healthcare stakeholders alike, CSL represents an essential entity in the ongoing fight against diseases and the advancement of healthcare technologies. Its commitment to innovation and patient care is a promising sign for the future of biotech, both locally and internationally.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.