Comprehensive Overview of CBA on the ASX

Introduction

The Commonwealth Bank of Australia (CBA) is one of the largest and most significant financial institutions on the Australian Securities Exchange (ASX). With a market capitalisation exceeding $200 billion, CBA plays a crucial role in the Australian economy, offering banking, insurance, and investment services. Its performance on the ASX is often a barometer for investor sentiment and broader economic trends.

Recent Performance

As of October 2023, CBA shares have seen fluctuations in response to a range of economic factors, including interest rates, inflation, and global economic conditions. Recently, CBA shares traded at approximately $102, marking a rebound from earlier dips earlier in the year. Analysts credit this recovery to improved consumer confidence and a stabilising global financial environment.

Market Trends and Developments

In recent months, CBA has focused on technological advancements and digital banking initiatives, aiming to provide improved services to its customers. The bank has invested heavily in digital platforms, which has shown positive results in customer engagement and retention. Additionally, the lender has been actively involved in sustainability initiatives, aligning itself with global shifts towards environmentally conscious banking and finance.

Competitively, CBA faces challenges from both traditional banks and fintech companies, but its established market presence and reputation for reliability continue to give it an edge. Recent reports indicate that CBA has been increasing its market share in home loans, countering competitive pressures effectively.

Conclusion

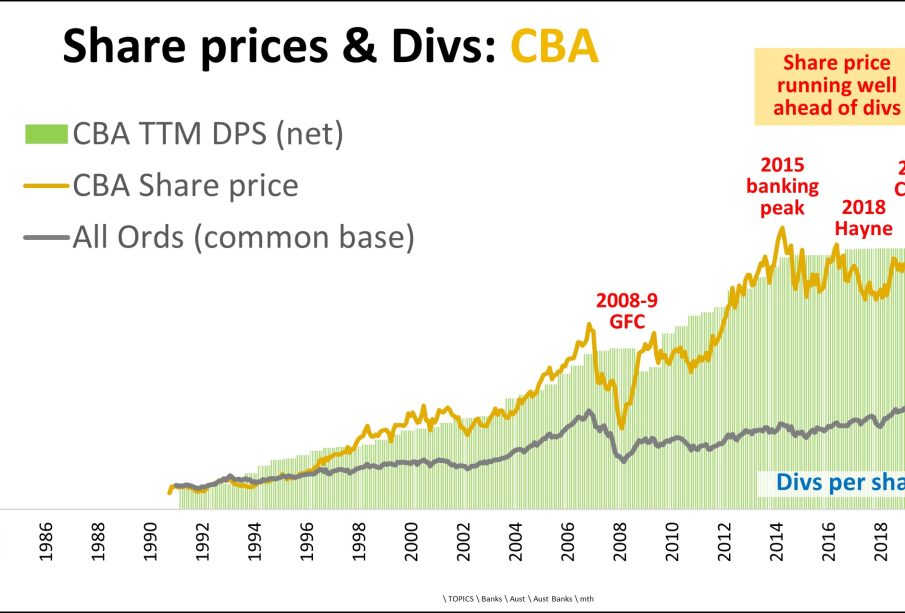

The outlook for CBA on the ASX remains cautiously optimistic, with a focus on innovation and sustainable practices likely to enhance its long-term growth. Market analysts forecast a steady performance moving into 2024, contingent upon the economic landscape and ongoing corporate developments. For investors, CBA’s consistent dividends and growth potential make it an attractive option on the ASX. As always, investors should conduct thorough research and consider market conditions before making investment decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.