Commonwealth Bank Online Banking Outage: What You Need to Know

Importance of Online Banking

Online banking has become an essential service for millions of Australians, providing 24/7 access to financial transactions. As more customers shift away from physical bank branches, the reliability of digital banking platforms is crucial. Recently, Commonwealth Bank (CBA), one of Australia’s largest banking institutions, experienced a significant outage that raised concerns for their users.

Details of the Outage

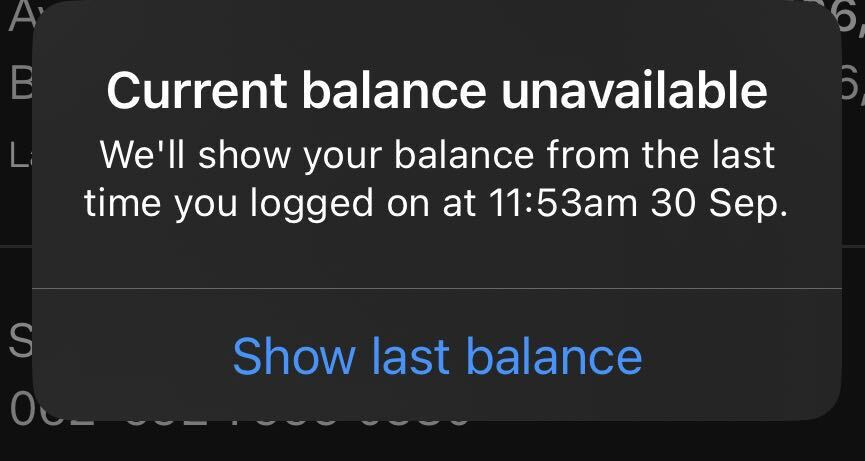

On March 27, 2023, Commonwealth Bank customers faced disruptions in online banking services. Many users reported being unable to access their accounts, complete transactions, or utilize essential features in the CBA app. The incident prompted widespread complaints on social media, and the bank’s customer service lines were overwhelmed with inquiries.

The outage lasted for several hours, causing significant inconvenience for those trying to manage their finances, pay bills, and engage in necessary banking activities. CBA publicly acknowledged the problem, attributing it to a technical issue that arose during routine maintenance.

Impact on Customers

For everyday Australians relying on the Commonwealth Bank for their banking needs, the implications of such outages can be severe. Customers reported feelings of frustration, especially those who had urgent transactions to complete. Many voiced concerns over the trustworthiness of online banking services, emphasizing the need for banks to ensure stability in their tech infrastructure.

The outage also brought to light the growing dependency on digital banking solutions, revealing how vulnerable customers can be to unforeseen technical issues. Following the incident, Commonwealth Bank assured its clients it would take necessary steps to prevent similar disruptions in the future, including a thorough review of their IT systems.

Conclusion and Future Implications

As banks like Commonwealth continue to innovate and enhance their online services, the risk of outages remains a possibility. This recent incident serves as a reminder of the importance of reliable digital banking infrastructure and transparent communication from financial institutions during crises. Customers are encouraged to stay informed about potential outages, sign up for alerts, and maintain alternative means of managing their finances in case of similar future occurrences.

As online banking becomes an integral part of financial management, the focus should not only be on enhancing user experience but also on ensuring that systems are robust enough to handle customer demands seamlessly, preserving trust in digital banking ecosystems.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.