Finance

The Importance of Bonds in Today’s Financial Landscape

Introduction to Bonds Bonds are essential financial instruments that play a crucial role in both personal investment strategies and the broader economy. ...Nvidia Stock Earnings Report: Q3 2023 Highlights

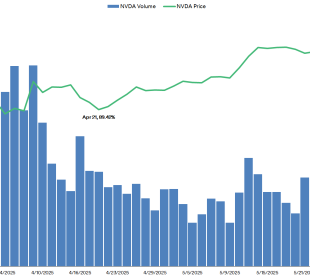

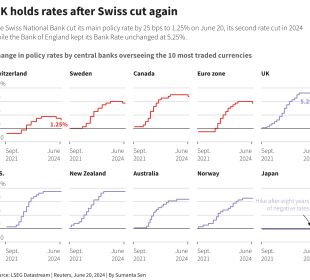

Introduction Nvidia Corporation, a leader in graphics processing units (GPUs), has recently released its earnings report for the third quarter of 2023. ...Current Trends in Banks’ Interest Rates in Australia

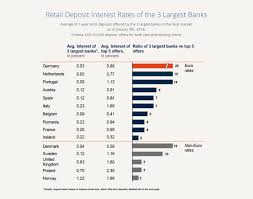

Introduction Banks’ interest rates are a critical element of the financial landscape, influencing everything from mortgages to savings accounts. As the Reserve ...Exploring WDS ASX: Recent Developments and Market Impact

Introduction The Australian Securities Exchange (ASX) has seen significant movements in many of its listed companies, with WDS (Western Drilling Services) emerging ...A Deep Dive into GME Stock: Current Trends and Insights

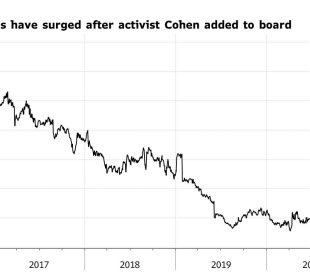

Introduction The performance of GameStop Corp. (GME) stock has become a significant topic of interest for investors and market analysts alike. As ...An Overview of Tax in Australia and Its Current Trends

Introduction to Tax in Australia Taxation is a critical aspect of government policy and economic health in Australia. It plays a vital ...Understanding Apple Share Price Trends

The Importance of Apple Share Price The Apple share price is a crucial indicator of the company’s financial health and overall market ...An Overview of Capital Gains Tax in Australia

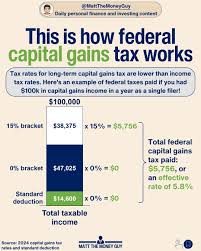

Introduction to Capital Gains Tax Capital Gains Tax (CGT) is a significant aspect of the Australian taxation system, particularly for investors and ...Understanding the Dow Jones Stock Markets

Introduction The Dow Jones Stock Markets, often referred to simply as the Dow, are a key barometer for the overall health of ...Understanding Recent Interest Rate Cuts by Banks in Australia

The Importance of Interest Rate Cuts Interest rates play a critical role in shaping economic stability and consumer behaviour. Recently, banks in ...

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.