BHP share price: What investors need to know

Introduction — why the BHP share price matters

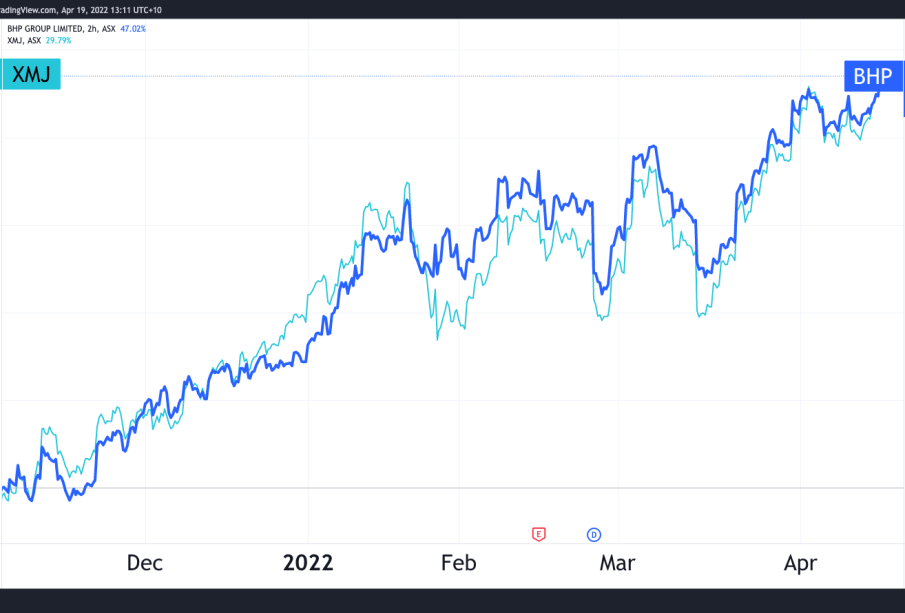

The BHP share price is a closely watched indicator for Australian and global markets. As one of the world’s largest diversified miners, BHP Group’s valuation influences pension funds, retail investors and the broader ASX. Movements in the BHP share price can reflect changes in commodity cycles, macroeconomic sentiment and company-specific developments, making it relevant to anyone tracking resource-sector performance or national export revenues.

Main developments and key drivers

Company profile and market exposure

BHP Group is a major producer of iron ore, copper, coal and petroleum and is dual-listed on the Australian Securities Exchange and other international bourses. This diversified portfolio means the BHP share price responds to multiple commodity markets rather than a single price driver.

Commodity prices and global demand

The most direct influence on the BHP share price is commodity demand and pricing—especially iron ore and copper. Demand from large consumers, particularly China, and global industrial activity affect revenue expectations. Volatility in commodity markets, whether driven by economic data, supply disruptions or geopolitical events, tends to translate into share-price movement for major miners like BHP.

Corporate actions and reporting

Quarterly production updates, annual reports, guidance revisions, dividend announcements and portfolio changes (such as asset sales or capital allocation decisions) are material to the BHP share price. Investors typically react to surprises in production, cost guidance or shifts in dividend policy.

Macro and currency influences

Interest rates, global growth expectations and the Australian dollar also play a role. A stronger AUD can affect export revenues when priced in local currency, while changes in global liquidity and risk appetite influence equities across the resources sector.

Conclusion — outlook and what to watch

For readers monitoring the BHP share price, the most important near-term signals will be commodity-price trends, BHP’s production and financial updates, and macro developments in major markets. While past movements are no guarantee of future performance, staying informed about earnings releases, commodity fundamentals and broader economic indicators will help interpret shifts in the stock. Investors should consider their own risk profile and consult financial advisers before making investment decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.