Australian Stock Market: September Volatility Ahead as ASX 200 Faces Critical Testing Period

Current Market Status

The ASX200, Australia’s main stock market index, recently fell to 8,771 points on September 2, 2025, recording a 1.75% decline from the previous session. Despite this drop, the index has shown resilience with a 1.24% increase over the past month and an impressive 8.25% gain compared to the previous year.

Market Composition and Significance

The S&P/ASX 200 (XJO) stands as Australia’s leading share market index, encompassing the top 200 ASX listed companies by float-adjusted market capitalisation. This benchmark index represents approximately 79% of Australia’s equity market as of June 2025.

The index structure is predominantly influenced by two key sectors:

– The Financials sector, which comprises almost one-third of the index, including major institutions like Commonwealth Bank of Australia

– The Materials sector, the second-largest component, featuring industry giants such as BHP Group Ltd and Fortescue Metals Group Limited

September Market Outlook

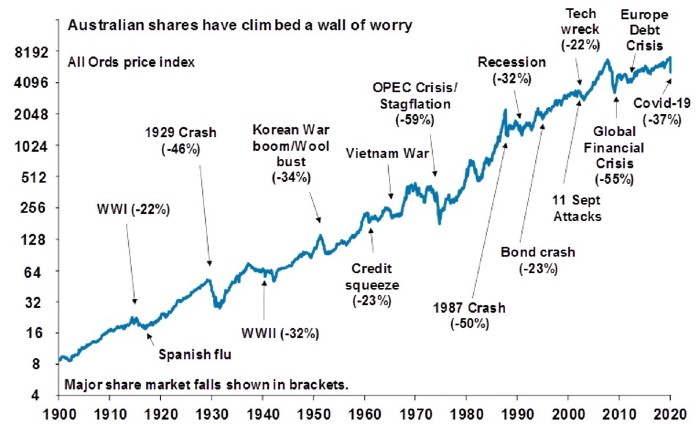

Historical data analysis indicates that September has traditionally been a challenging month for the ASX 200, typically initiating a 12-week period of significant market volatility. This month has historically been the weakest in the ASX investing calendar, often characterized by some of the largest swings in local stock prices over the past four decades.

Despite recent market challenges, the ASX 200 has shown remarkable strength, with a notable rally of approximately 5% during July and August 2025 – representing about half of its typical annual return.

Recent Trading Activity

The Australian share market is experiencing some pressure, with the ASX 200 expected to open 35 points or 0.4% lower, following negative performance in global markets. This follows trends in the United States, where the Dow Jones declined 0.55%, the S&P 500 fell 0.7%, and the Nasdaq dropped 0.8%.

Sector Performance

The energy sector shows promising signs, with companies like Beach Energy Ltd and Santos Ltd potentially benefiting from rising oil prices. Recent data shows WTI crude oil prices increased by 2.4% to US$65.54 per barrel, while Brent crude oil rose 1.3% to US$69.03 per barrel, driven by concerns over Russian supply.

The second quarter of 2025 has witnessed increased trading volumes due to macroeconomic volatility, with particularly strong growth observed in 90-day bills and 3-year bond futures.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.