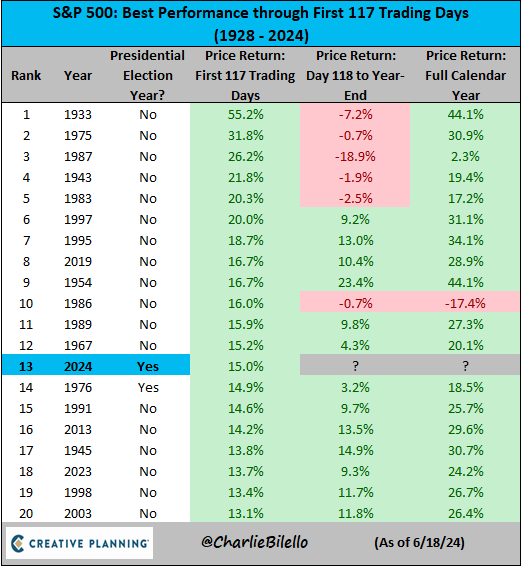

An Overview of the S&P 500: Importance and Insights

Introduction

The S&P 500 index is one of the most widely recognized benchmarks for the performance of the U.S. stock market, comprising 500 of the largest companies listed on stock exchanges, primarily the New York Stock Exchange and NASDAQ. Its relevance extends far beyond the United States, as it serves as an essential indicator for investors across the globe, influencing investment strategies and economic forecasts. Understanding the S&P 500 is crucial for anyone interested in financial markets and economic trends.

Current Performance of the S&P 500

As of October 2023, the S&P 500 has demonstrated resilience amidst various economic challenges, including rising interest rates and inflation concerns. Recently, the index has fluctuated, responding to market reactions to Federal Reserve policy changes and corporate earnings reports. In the past two weeks, the S&P 500 has shown a modest upward trend, attributed largely to strong earnings from tech giants and improved consumer confidence.

According to financial analysts, the index recently reached a level of approximately 4,500 points, which represents a 15% increase over the past year. This increase is notable, especially in a year marked by economic uncertainty, reinforcing the index’s reputation as a barometer for market health and investor sentiment.

Sector Performance

When examining the S&P 500, it’s essential to consider the performance of various sectors within the index. The technology sector has continued to lead, with companies like Apple and Microsoft posting significant earnings growth. Conversely, sectors such as energy and utilities have shown mixed performance as market dynamics shift in response to global energy prices.

Conclusion and Future Outlook

The S&P 500 remains a vital indicator of market sentiment and economic health, reflecting investor confidence and the overall performance of the U.S. economy. Looking ahead, analysts predict that the index may continue to navigate through volatility, particularly as macroeconomic indicators evolve and the Federal Reserve evaluates its monetary policy.

For investors, understanding the trends of the S&P 500 is crucial. Whether pursuing equity strategies or assessing the overall investment climate, the S&P 500 will likely continue to play an instrumental role in investment decisions and economic analyses. As we move forward into 2024, keeping an eye on the developments of this index will remain essential for anyone engaged in the financial markets.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.