An Overview of the ASX200 Index and Its Market Influence

Introduction

The ASX200, comprising the top 200 companies listed on the Australian Securities Exchange (ASX), plays a pivotal role in the economic landscape of Australia. As a benchmark index, it reflects the performance of these major corporations and provides insight into the health of the Australian economy. Given its significance, understanding the ASX200 is essential for investors, analysts, and anyone interested in the market dynamics.

What is ASX200?

The ASX200 is a market capitalization-weighted index that includes publicly listed companies across various sectors in Australia, including finance, healthcare, and mining. It was first introduced in 2000, and since then has become a key reference point for investors aiming to gauge overall market performance. The index is rebalanced quarterly, ensuring that only the top-performing companies remain integral to its composition.

Recent Performance and Trends

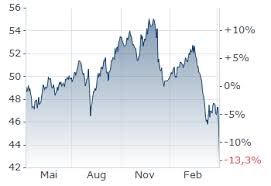

As of late 2023, the ASX200 has displayed resilience amid global economic uncertainties. The index saw a modest rise of approximately 7% in the first three quarters of the year, driven largely by gains in sectors such as technology and healthcare, which have outperformed during the post-pandemic recovery phase. Notably, the strong performance of companies such as CSL Limited and BHP Group has bolstered investor confidence.

However, challenges remain. Concerns over inflation and interest rate hikes have led to mixed sentiments among investors. Analysts predict that while the index may face volatility, robust fundamentals in key sectors could lead to steady growth opportunities over the long term.

Impact on Investors

The ASX200 serves as a crucial tool for investors in Australia and around the globe. It provides a diversified exposure to the largest companies in the country and is often used as a benchmark for Australian equity investment performance. Exchange-traded funds (ETFs) that track the ASX200, such as the SPDR S&P/ASX 200 Fund, allow investors to gain access to this index effortlessly, making it a popular option for passive investment strategies.

Conclusion

In summary, the ASX200 is a key financial index that reflects the strength of the Australian economy. With current trends demonstrating resilience amidst economic challenges, it remains a focal point for both local and international investors. Forecasts suggest that maintaining a keen eye on the ASX200 could provide valuable insights into investment opportunities, allowing stakeholders to navigate the complexities of the ever-evolving market landscape effectively.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.