A Comprehensive Overview of the Nikkei 225 Index

Introduction

The Nikkei 225, Japan’s premier stock market index, is a crucial barometer of the country’s economic performance and investor sentiment. Comprising 225 of the largest publicly traded companies on the Tokyo Stock Exchange (TSE), the index is often seen as a reflection of Japan’s industrial health and a gateway for global investors to assess the economic climate in Asia. Understanding its movements can provide valuable insights into market trends and economic strategies.

Recent Performance and Trends

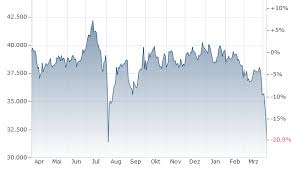

As of October 2023, the Nikkei 225 has experienced notable fluctuations in the wake of both international and domestic events. In 2023, the index reached a 33-year high, closing at 32,658.34 points, buoyed by strong corporate earnings reports and a resilient export market. However, concerns over potential interest rate hikes by the Bank of Japan and global economic uncertainties have introduced volatility.

Investors have been particularly focused on technology stocks, which form a significant portion of the index. Companies like Sony, Toyota, and SoftBank have witnessed impressive share price growth, reflecting a broader recovery in consumer confidence and innovation in tech-driven sectors.

Economic Indicators Influencing the Nikkei 225

The performance of the Nikkei 225 is significantly influenced by various economic indicators, including GDP growth, unemployment rates, and consumer spending in Japan. Recent reports indicate a modest growth rate of 1.4% year-on-year for Japan’s GDP, which, while slower than some global counterparts, has been sufficient to maintain investor interest in the Japanese market.

Additionally, external factors such as US-China trade relations and global inflation concerns have also impacted investor behavior. Analysts are keeping a close eye on how geopolitical tensions could influence the index, particularly as Japan navigates its role in the Asia-Pacific trade landscape.

Conclusion

The Nikkei 225 remains an essential indicator of not only Japan’s economic health but also the mood of the global markets. For investors looking at opportunities in Asia, keeping track of this index is vital as it reflects underlying trends that could signal both risk and opportunity. As the index continues to respond to global economic dynamics, traders and investors should remain vigilant, adaptable, and informed about how various factors play out in shaping the future of Japan’s economy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.