A Comprehensive Overview of NASDAQ

Introduction to NASDAQ

The NASDAQ, which stands for National Association of Securities Dealers Automated Quotations, is an electronic stock exchange that has become a vital component of the global financial system. Recognised for its high-tech and growth-oriented focus, it serves as a major indicator of the performance of the tech sector and overall market trends. Understanding the recent movements in the NASDAQ is crucial for investors and market watchers alike.

Recent Performance and Market Trends

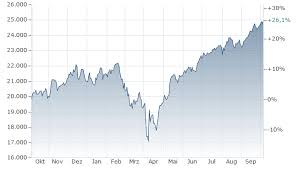

As of October 2023, NASDAQ has seen significant volatility influenced by various factors including interest rate fluctuations, inflation concerns, and earnings reports from key technology companies. In the first half of the year, the index experienced a rebound, climbing steadily as investors regained confidence amidst improving economic conditions. However, the market faced turbulence in July and August due to looming economic uncertainties, leading to noteworthy fluctuations in stock prices.

Notably, companies within the index such as Apple, Amazon, and Microsoft showed mixed earnings results for the third quarter. While some reported growth driven by strong consumer demand for technology products and services, others faced challenges with rising production costs and regulatory scrutiny. This divergence has contributed to a cautious optimism among investors as they analyse the long-term prospects of these tech giants.

Impact and Future Outlook

The NASDAQ is not only a barometer for technology stocks but also influences global market sentiments. Its performance can affect investor confidence and overall market liquidity, impacting everything from consumer spending to employment rates. Financial experts forecast that as inflation stabilises and interest rates potentially normalise, the NASDAQ could emerge as a more stable investment avenue.

Market analysts continue to monitor geopolitical factors and technological advancements that could either stimulate or hinder growth in the NASDAQ and global markets. While bets on a technological recovery remain high, there exists a cautious sentiment that highlights the importance of diversifying investment portfolios.

Conclusion

In summary, the NASDAQ remains a critical indicator of market health, particularly for technology-focused investments. As the year closes, investors are encouraged to stay informed about both macroeconomic factors and sector-specific developments that could shape the future of the NASDAQ and the economy. Understanding these nuances can help guide informed investment decisions going forward.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.