A Comprehensive Look at the All Ordinaries Index

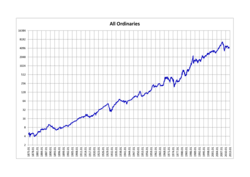

Introduction to the All Ordinaries Index

The All Ordinaries Index, commonly known as the All Ords, serves as a benchmark for the Australian stock market, representing the performance of the top 500 companies listed on the Australian Securities Exchange (ASX). Established in 1980, the index provides crucial insights into the overall market trends, economic health, and investor sentiment in Australia.

Recent Performance and Market Trends

As of October 2023, the All Ordinaries Index has demonstrated resilience despite global economic uncertainties. The index recorded a steady upward trajectory through mid-2023, bolstered by strong performances in sectors such as healthcare, financial services, and technology. Analysts reported that the index closed at 7,680 points in late October, marking a 12% increase compared to the previous year. This growth illustrates the market’s recovery from post-pandemic economic challenges.

Key Contributors to Recent Growth

Some significant influencers of the All Ords performance include:

- Healthcare Sector: Companies like CSL Limited and Cochlear Limited have shown robust growth aligned with increased global healthcare spending.

- Financial Services: Major banks such as Commonwealth Bank and Westpac have played vital roles in the market’s positive outlook, driven by rising interest rates.

- Technology Sector: Firms such as Afterpay and Xero continue to innovate and expand, contributing positively to the index.

The Significance of the All Ordinaries Index

The All Ordinaries Index is crucial for investors as it reflects the performance of the Australian economy. It is a vital tool for portfolio management and investment decisions. Financial analysts and institutional investors often use the index to benchmark fund performance and gauge market trends. Additionally, the All Ords is considered an indicator of broader economic conditions in Australia, providing insights into consumer confidence and corporate health.

Conclusion and Forecast

<pLooking ahead, analysts project that while the All Ordinaries Index may face volatility due to global economic factors such as inflation and geopolitical tensions, the overall outlook remains optimistic. Continued growth is anticipated, driven by innovation in key sectors and a recovering global economy. For investors, keeping an eye on the All Ords will remain crucial for making informed investment decisions in the evolving financial landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.