Mortgage Rates Today — How Movements Affect Australian Homeowners

Introduction — Why mortgage rates today matter

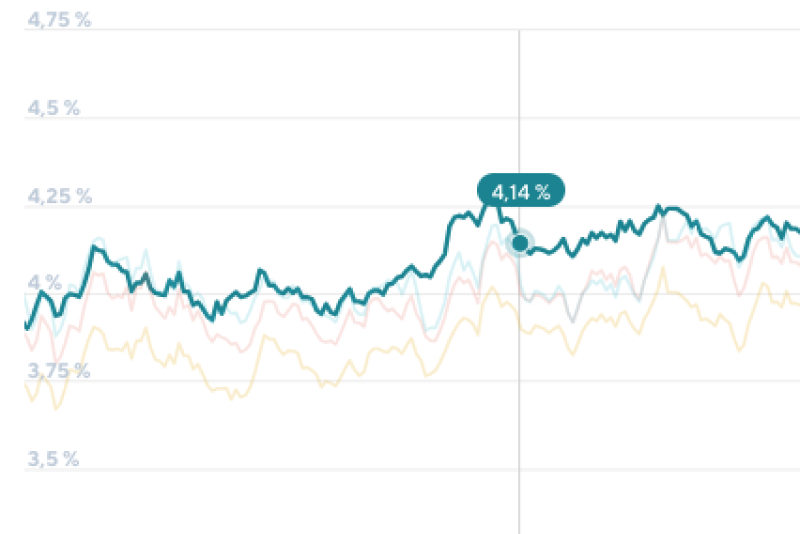

Mortgage rates today are a central concern for Australians with home loans, prospective buyers and property investors. Changes in interest rates influence monthly repayments, borrowing capacity and overall housing affordability. Keeping abreast of mortgage rates today helps households plan budgets, decide on fixed or variable deals and time refinancing or new purchases.

Main body — What drives mortgage rates and how they affect you

Key influences on mortgage rates today

Mortgage pricing is shaped by several economic and market forces. Central bank policy settings, such as decisions by the Reserve Bank of Australia, guide short‑term interest rates and set the tone for variable rates. Wider economic indicators — inflation, employment and growth figures — feed into expectations about future policy. Global bond yields and credit market conditions also affect the cost at which lenders can raise funds, which in turn influences the mortgage rates they offer.

Different rate types and borrower impact

Borrowers typically choose between variable and fixed rates. Variable mortgage rates today can move with market conditions and central bank actions, affecting repayments in real time. Fixed rates provide repayment certainty for a set term but may carry break costs and different eligibility criteria. Mortgage product features — such as offsets, redraw facilities and repayment frequencies — also change the effective cost of a loan.

Practical considerations for Australians

When assessing mortgage rates today, borrowers should compare the annual percentage rate, fees and loan features rather than focusing solely on headline rates. Loan‑to‑value ratio, deposit size, credit history and product type influence the rate a lender will offer. For many households, small rate changes can materially alter monthly budgets, so regular review of mortgage arrangements is prudent.

Conclusion — What readers should take away

Mortgage rates today are the result of interconnected domestic and global factors and can change as economic data and policy decisions evolve. For readers, the immediate takeaway is to monitor reputable sources, compare offers, and consider professional advice tailored to individual circumstances. Understanding the drivers behind mortgage rates today helps households make informed decisions about borrowing, refinancing and managing long‑term housing costs.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.