Understanding the s and p 500: Why It Matters to Investors

Introduction: Why the s and p 500 matters

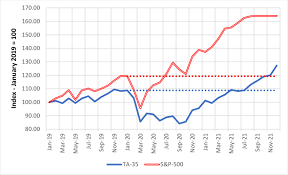

The s and p 500 is one of the most widely used benchmarks for the US equity market. For investors, journalists and policymakers, developments in the index signal broader trends in corporate profits, risk appetite and macroeconomic expectations. Its breadth and market-cap weighting make it a practical reference point for portfolio performance and a cornerstone of passive investing strategies.

Main body: Structure, mechanics and practical facts

What the index is and how it is constructed

The s and p 500 comprises 500 large-cap companies domiciled in the United States and is maintained by S&P Dow Jones Indices. It is market-cap weighted, meaning larger companies have greater influence on index returns. Inclusion criteria include market capitalisation, liquidity, public float, sector representation and a history of positive earnings.

Role in markets and popular investment vehicles

The index is widely used as a performance benchmark by fund managers and individual investors. Exchange-traded funds (ETFs) such as SPY (SPDR S&P 500 ETF Trust) and VOO (Vanguard S&P 500 ETF) track the s and p 500 and provide low-cost exposure to its constituents. Institutional investors also use futures and options on the index for hedging and exposure management.

Sectors and diversification

The s and p 500 spans all major sectors, including information technology, health care, financials and consumer discretionary. Because it covers a large portion of the US equity market by market capitalisation, it offers exposure to a diversified set of industries while remaining concentrated in the largest firms.

Conclusion: Implications and outlook for readers

The s and p 500 remains a foundational tool for assessing US equity market health. For long-term investors, its historical record underscores the potential benefits of broad diversification and staying invested through market cycles, while also reminding readers that short-term volatility is inherent. As a benchmark, it will continue to shape portfolio construction, index-linked products and market commentary. Readers should consider their own investment objectives and risk tolerance when using the s and p 500 as part of an investment strategy and consult a financial adviser where appropriate.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.