Google share price falls as analysts weigh in amid Waymo financing

Why the Google share price matters

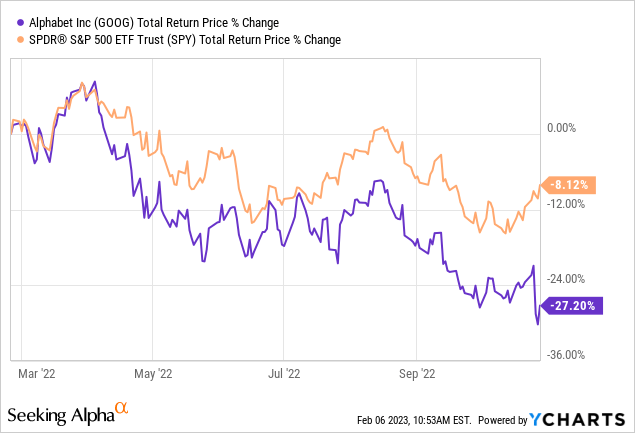

The Google share price (Alphabet Inc., GOOG) is a key market barometer for investors watching big‑tech strength, AI progress and autonomous‑vehicle financing. Movements in GOOG affect major indices and investor sentiment, so short‑term price swings and analyst commentary are closely followed by retail and institutional investors alike.

Market snapshot and trading details

Current trading

According to TradingView, Alphabet Inc. Class C (GOOG) is trading around US$333.34, down roughly −1.22% over the past 24 hours. MarketWatch lists a similar quote of US$331.96 with a reported volume of 36.99 million shares versus a 65‑day average volume near 23.17 million.

Intraday and annual ranges

MarketWatch data indicate a day range roughly between US$329.37 and US$344.25, while the 52‑week range sits approximately between US$142.66 and US$350.15. These ranges underline that while the stock has pulled back from intraday highs, it remains well above its yearly low.

Recent news shaping sentiment

Analysts and media reports have supplied fresh catalysts for the Google share price. Mizuho reportedly raised its price target to US$400 from US$365, reflecting increased bullishness among some brokerages. Goldman Sachs and Jefferies have remained positive, with buy ratings reported for Alphabet shares.

Corporate and strategic developments also feature prominently. Reports indicate Google plans to spend about US$4.75 billion to secure sufficient electricity supply, a move tied to expanding cloud and AI operations. Waymo, Alphabet’s self‑driving unit, drew investor attention with fundraising activity: reports vary but place Waymo’s valuation in the range of roughly US$110–126 billion amid plans to raise sizeable financing (reports cite intentions to raise about US$16 billion in a financing round).

Legal and regulatory items are part of the backdrop too. Reuters reported Google defeated a bid to force a US$2.36 billion privacy‑class action payout, while analysts have flagged evolving European scrutiny of US big tech as a potential headwind.

Conclusion and implications for investors

The immediate picture for the Google share price is mixed: upward analyst revisions and large‑scale strategic moves (energy investments, Waymo fundraising) add upside potential, while legal, regulatory and macro volatility create downside risks. With several brokerages keeping positive stances and some raising targets (Mizuho’s US$400 example), short‑term momentum may depend on upcoming corporate updates and broader market flows. Investors should note the elevated trading volume and range compression, and consider monitoring earnings, regulatory announcements and Waymo financing progress before making decisions. This report is informational and not investment advice.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.