What you need to know about nab interest rates

Introduction: Why nab interest rates matter

Changes to nab interest rates affect borrowers, savers and investors across Australia. Interest rate movements determine mortgage costs, the price of borrowing on margin loans, and the returns available on term deposits. Recent published information from National Australia Bank (NAB) shows adjustments across product lines that are relevant for customers reviewing borrowing costs or seeking secure deposit returns.

Main details and recent moves

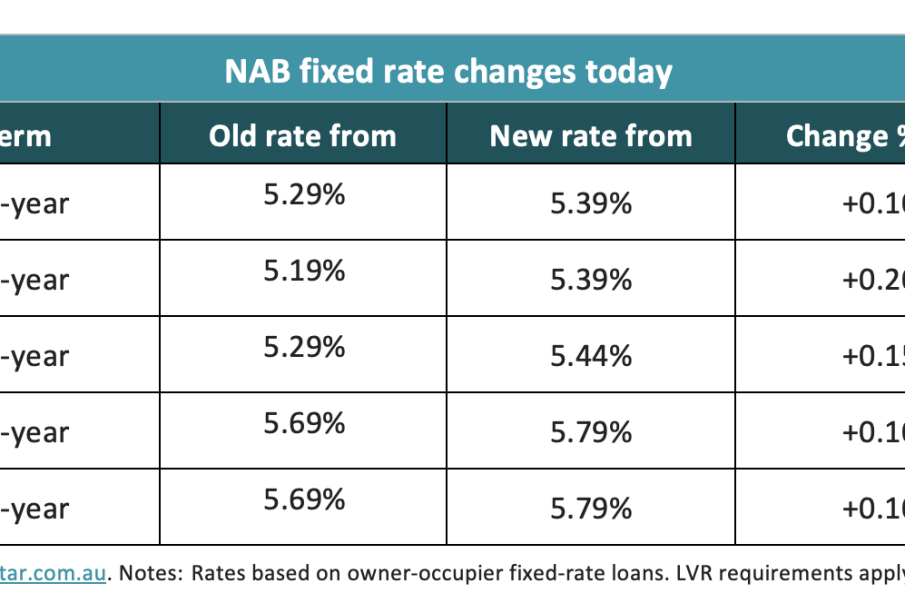

Fixed home loans

NAB has raised its fixed home loan interest rates by up to 0.40 percentage points. The bank reported that this adjustment has increased its lowest one-year fixed rate, reflecting a move towards higher fixed borrowing costs for customers choosing fixed-rate mortgages.

Margin loans

NAB’s published margin loan variable interest rates (per annum) are tiered by loan size:

- Less than $250,000: 9.25% p.a.

- $250,000 to less than $1.0M: 9.00% p.a.

- $1.0M and above: 8.75% p.a.

These rates indicate the cost of borrowing against securities through NAB’s margin lending product and are variable, meaning they can change over time with market conditions or lender pricing decisions.

Term deposits

NAB lists a term deposit rate of 2.85% p.a. (monthly interest). Additional product details note that terms greater than two years for new NAB Term Deposits are available only through the online application form for individual customers. Existing term deposits may be rolled over to terms greater than two years using self-serve channels on Internet Banking or the NAB App, subject to eligibility. NAB also states there are no set up or monthly service fees for its term deposits.

Conclusion: What this means for customers

The recent changes mean prospective fixed-rate borrowers may face higher upfront costs, while margin lending remains comparatively expensive with variable rates in the high single digits. Savers seeking a conservative option can expect term deposit returns at about 2.85% p.a., with multi-year options subject to online application rules. Customers should review their individual circumstances, compare product features, and consult NAB’s official channels for the latest, personalised rates before making decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.